30% Price Drop Drives Notcoin (NOT) Holders to Abandon Telegram Coin Ship

The excitement surrounding Notcoin (NOT), a once-promising Telegram-based tap-to-earn project, has significantly declined in recent weeks. This dip in sentiment is likely tied to the token’s disappointing price action.

Once a top performer among the top 100 cryptocurrencies, NOT’s value has dropped by 30.76%. But instead of buying the dip, the cryptocurrency holders appear to be abandoning the ship.

Investors Flee Notcoin Following Month-Long Decline

On August 19, Notcoin’s price jumped to $0.011. This increase sparked speculation that the token could hold onto the hike. However, BeInCrypto’s on-chain analysis found what led to the short-lived upswing.

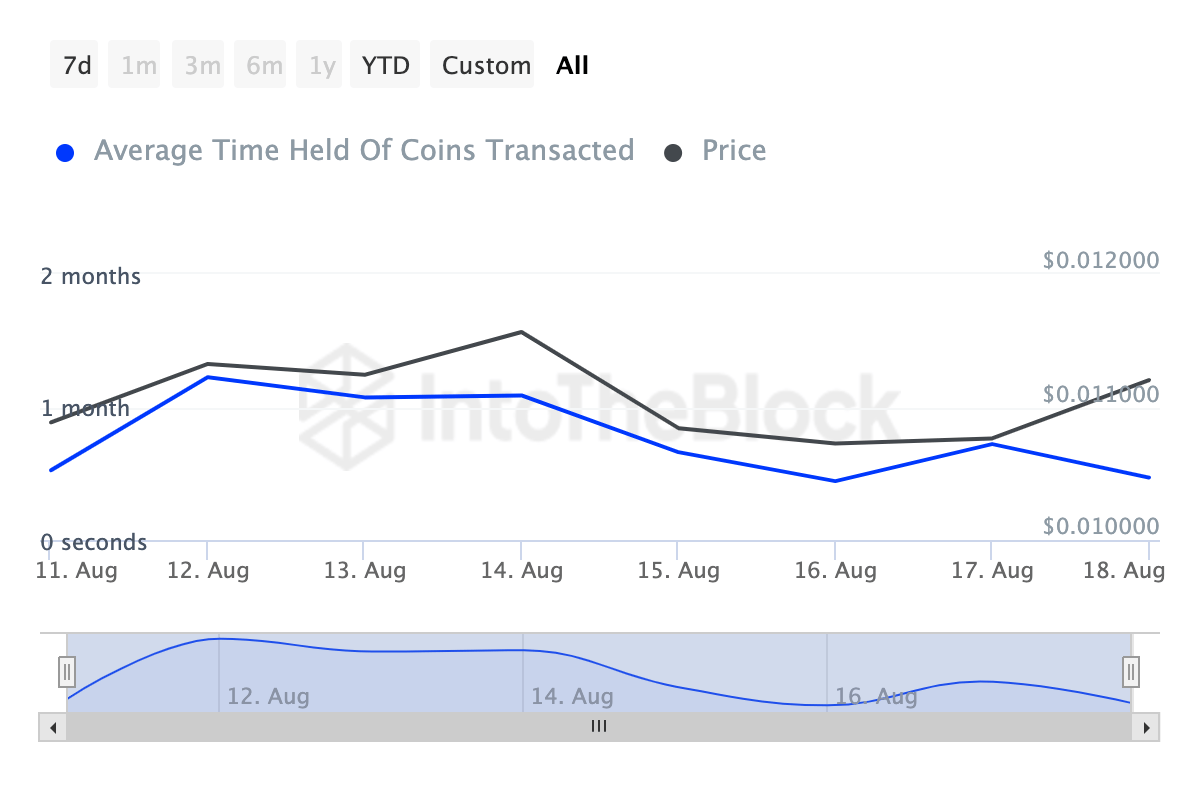

According to IntoTheBlock, the average holding time of transacted coins on Notcoin’s network has dropped by nearly 62% over the past week. Additionally, the volume of transacted coins over the last 30 days has declined.

The “Coins Holding Time” metric tracks how long a cryptocurrency is held before being sold or transacted. When this metric rises, it suggests holders are reluctant to sell, leading to price stability or growth.

Read more: 5 Top Notcoin Wallets in 2024

Notcoin Coins Holding Time. Source: IntoTheBlock

However, the decrease in NOT’s holding time reflects growing selling pressure and diminished confidence in its short-term potential.

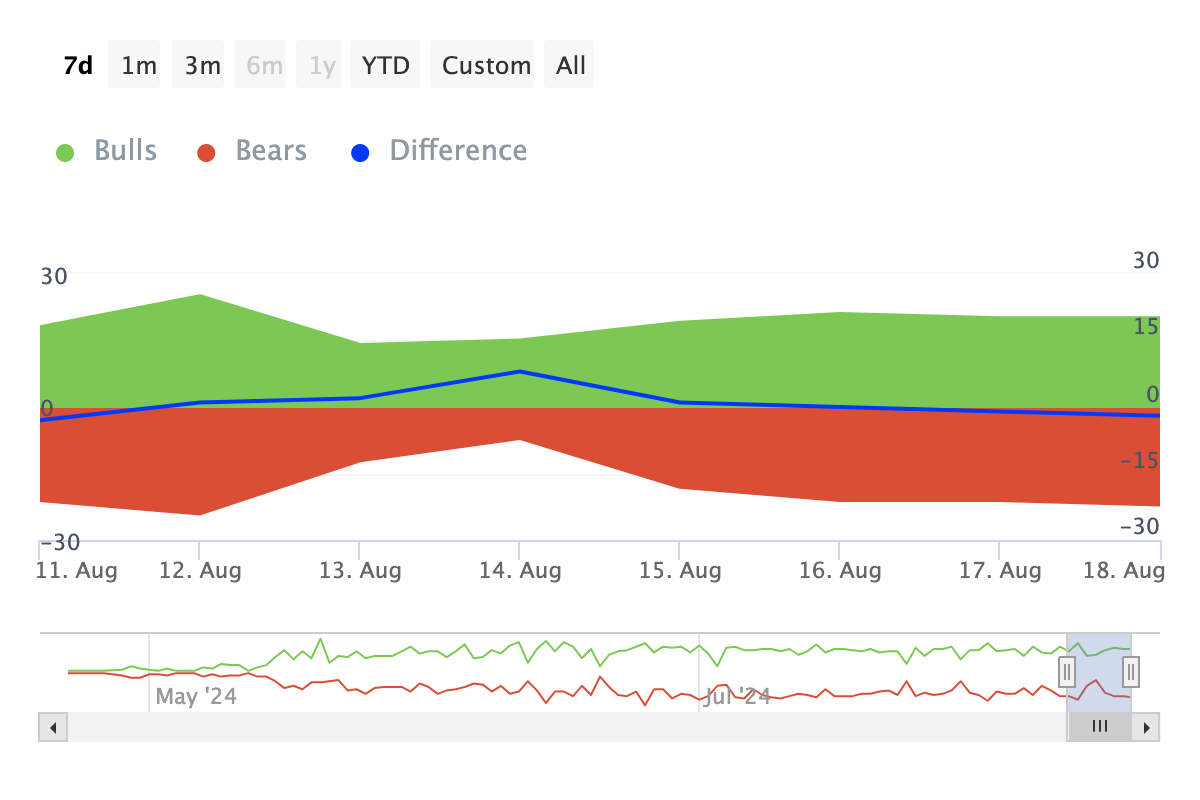

Furthermore, blockchain analytics reveal that retail investors aren’t the only ones selling NOT. The Bulls and Bears indicator shows more bears than bulls, signaling increased selling activity.

In this context, bulls represent addresses that bought 1% of the total trading volume, while bears are those selling 1% of the volume. If this trend persists, Notcoin may struggle to recover from its 30% decline.

Notcoin Bulls and Bears Indicator. Source: IntoTheBlock

NOT Price Prediction: Another Drop Imminent

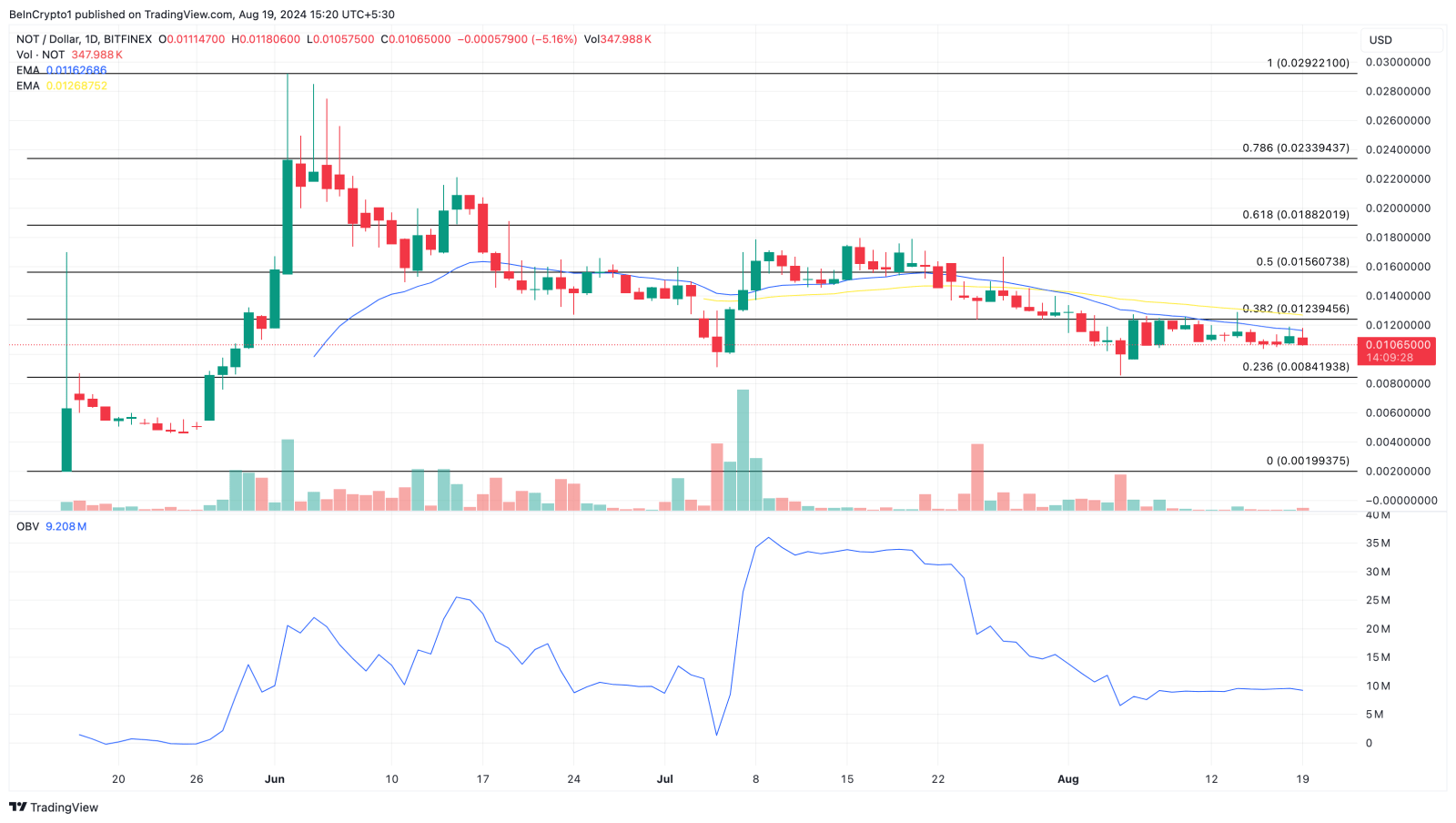

Notcoin’s technical setup below highlights the failure to break the bearish market structure. At press time, the cryptocurrency trades at $0.010.

Furthermore, the price is attempting to flip the 20-day EMA (blue) but remains clearly below the 50 EMA (yellow). EMA stands for Exponential Moving Average and measures a cryptocurrency trend direction over a period of time.

When the price is above the EMA, the trend is bullish. But since NOT’s price is below the short to mid-term indicators, the trend is bearish. Apart from that, the formation of a death cross, which is shown by the crossover of the longer EMA above the shorter one, gives credence to the bearish bias.

Read more: Where To Buy Notcoin: Top 5 Platforms In 2024

Notcoin Daily Analysis. Source: TradingView

Additionally, the On Balance Volume (OBV), an indicator that gauges buying and selling pressure, is flat. This implies that NOT is starved of accumulation.

Unless Notcoin’s market structure improves, the cryptocurrency’s price may drop to $0.0084. However, if market participants deem it fit to buy the dip and the price rises above the 20 EMA, the trend may reverse. Should this be the case, NOT’s price may reach $0.012.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Ravencoin

Ravencoin  Polygon

Polygon  Dash

Dash  Decred

Decred  Synthetix Network

Synthetix Network  Zilliqa

Zilliqa  Qtum

Qtum  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Energi

Energi