80% of Short-Term Bitcoin Holders Currently Underwater on Positions, According to On-Chain Analyst

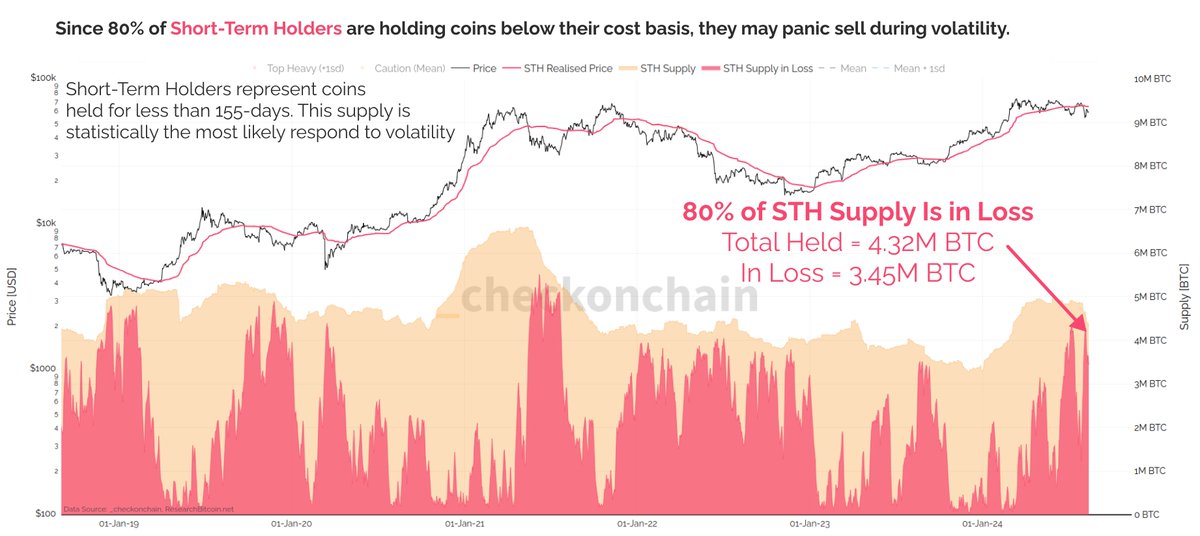

More than 80% of short-term Bitcoin holders are currently losing money on their BTC positions, according to a popular on-chain analyst.

The pseudonymous on-chain sleuth known as Checkmate tells his 97,000 followers on the social media platform X that the short-term holder (STH) metric looks similar to charts in 2018, 2019 and mid-2021, all of which signaled investor panic and incoming bearish trends.

The analyst defines STH as entities that have held their coins for less than 155 days.

Source: Checkmate/X

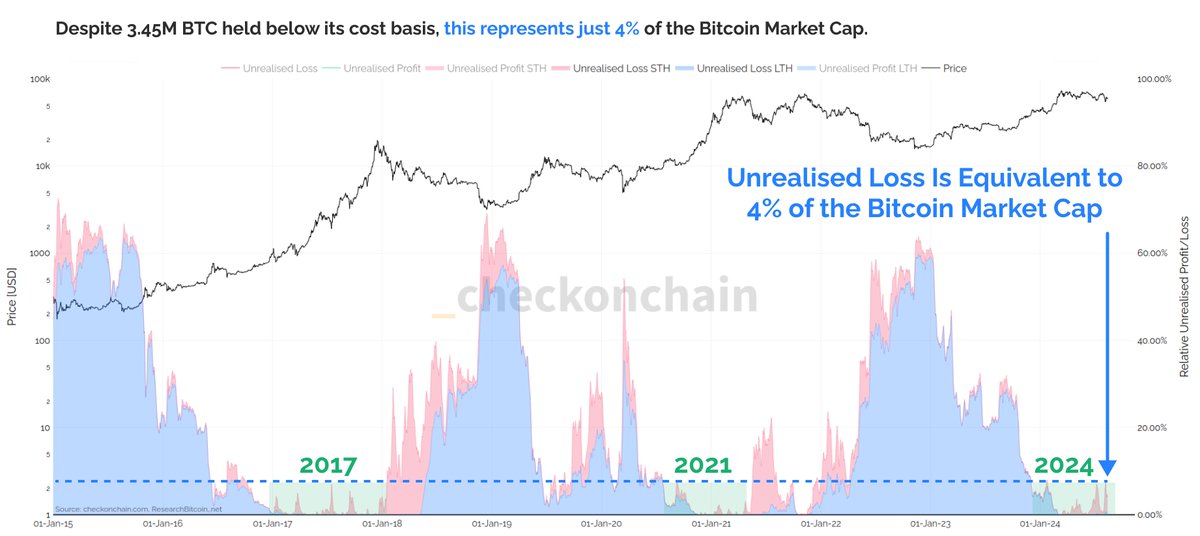

But the analyst says this time could be different because while a huge number of short-term holders are in the red, their cost basis is not way below the current value of BTC.

“Just because a coin is held below its cost basis, it doesn’t tell us how bad it is. Being under by -1% is very different psychologically to being under by -20%. Despite 80% of STH coins being in loss, the magnitude of unrealized loss is just 4% of the market cap.”

Source: Checkmate/X

The trend also appears limited to short-term holders.

Overall, 81% of Bitcoin investors are making money at the current BTC price, according to the crypto analytics firm IntoTheBlock.

Bitcoin is trading at $60,438 at time of writing. The top-ranked crypto asset by market cap is up more than 3% in the past 24 hours.

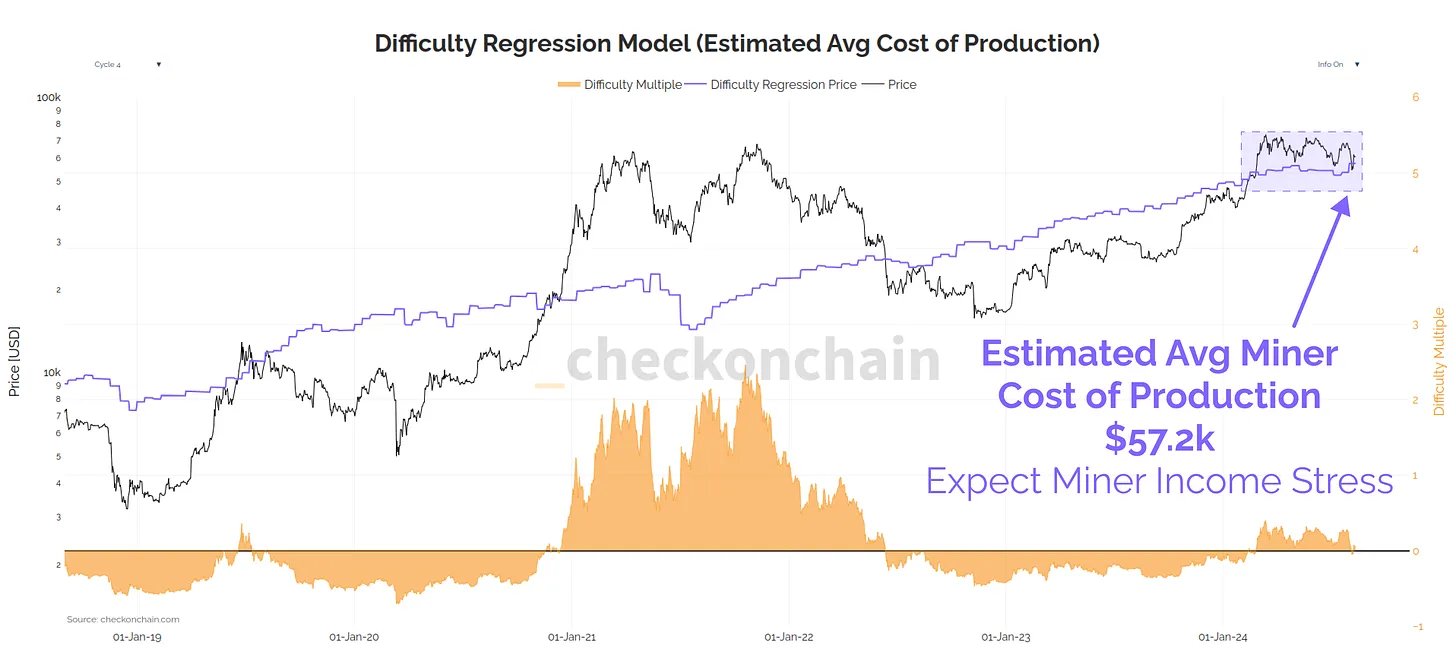

Checkmate also estimates that the average price to mine Bitcoin is currently around $57,200, indicating that miners are still making profits at current levels.

“I can only imagine miners are white-knuckling the current environment, and barely profitable. For HODLers, this is largely irrelevant (and expected). For miners and shareholders… hope for a rally.”

Source: Checkmate/X

Generated Image: DALLE3

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur