Airdrop backscratching is crypto’s latest dilemma

We need to talk

Now that I’ve spiked your anxiety, I want you to define neutrality.

A CoinDesk report Thursday investigated EigenLayer for distributing a list of employee wallet addresses ahead of airdrops.

“We want to make clear that we have no knowledge or evidence of any employee at Eigen Labs pressuring any team to unduly benefit the Eigen Labs corporate entity or its employees,” Eigen Labs said in a community update last night. It also seeks any evidence of “improper behavior.”

Loading Tweet..

The TL;DR is that employees at Eigen Labs reportedly received crypto from projects working in the ecosystem, and as I said earlier, wallet addresses were supposedly distributed.

This isn’t the first time that Eigen Labs has faced this type of scrutiny. The firm pointed out that it initially changed its incentive policy back in May after Justin Drake and Dankrad Feist of the Ethereum Foundation signed on as advisers.

Loading Tweet..

“As an Eigenlayer project, we’re in touch with the team regularly and we never had such a request about our upcoming airdrop. Quite the contrary, they help us a lot and I believe projects can reward any person they deem important, it just needs to be vetted by the community first,” Peter Kris, co-founder of Gasp.xyz, told me.

But I’m not here to focus on the ‘did they, didn’t they.’ Instead, this report and the response from Eigen Labs (which changed its policy around such payouts to employees because they claim to want to be neutral) has started an important debate within the space: What does it mean to be neutral and how can projects avoid conflicts of interest?

“It is clear that when contributors accept airdrops as tips, such incentives affect business decisions of the protocol developers,” Tim Shekikhachev, Resolv Labs co-founder, said. “As compared to public companies where business gifts rarely cover more than a few managers involved in a deal, the conflict of interest in such situations is more pronounced, because the majority of the team can get a benefit and everyone is so aligned to bypass actual governance.”

“Ironically for strategic VC investors, lack of their protections is at this moment compensated by outsized returns over shorter investment periods, so there does not seem to be an outcry for transparency. People just optimize for other, more critical factors influencing investment decisions.”

Nika Koreli, co-founder and chief technology officer at Hinkal, said that “privacy is crucial in trading strategies,” but that “everyone should play a fair game” or else it puts the industry at risk.

When it comes to these types of conversations, there isn’t an easy answer or solution.

Mason Borda, CEO of Tokensoft, wonders if these types of payments are “actually worth it at the end of the day.”

“EigenLayer has a smart, driven team and that means they will be analyzing all product decisions from multiple angles and evaluating trade offs. Payments to individuals will result in a negligible influence in these conversations,” Borda said.

I asked Borda specifically if we need an industry standard moving forward, because as it stands right now the water’s murky.

“It really has to be on the founders,” he said. “Founders should apply whatever standards they have for employees acting as advisors to third parties. Backing into existing industry norms is the best way to stay above board.”

Eigen Labs, for its part, says that the “community’s trust in our neutrality is critical” and added that they had taken steps to mitigate potential incentives “many months ago.” To be fair, May was only about four months ago but the point remains: the team says it tried to get in front of this ahead of time.

One thing’s for certain: this report is the spark for a longer and tougher dialogue in crypto. One that could lead to some positive, transparent change in the industry.

— Katherine Ross

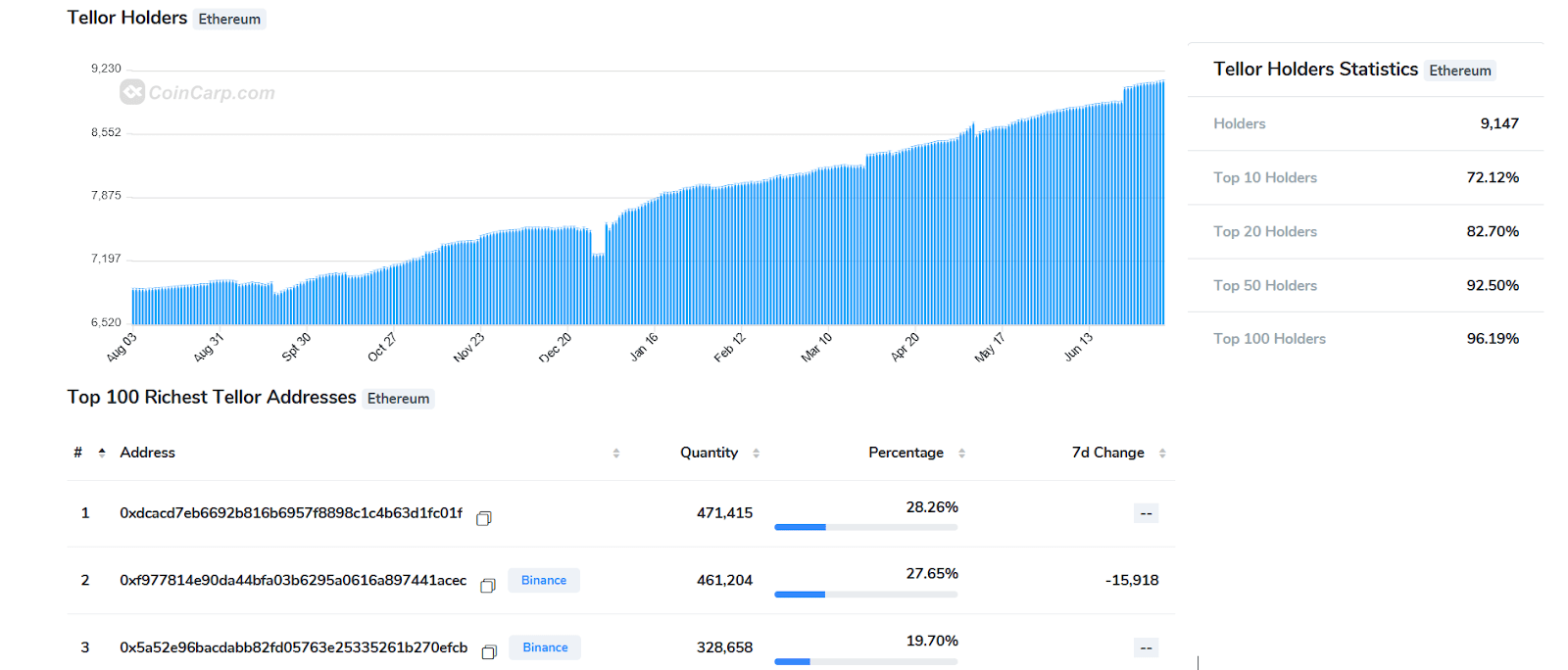

Data Center

- BTC and ETH are basically flat on the day, sitting at $58,400 and $2,600 apiece.

- RUNE, FTM and AAVE lead the top-100 with between 6% and 3.5% gains. APT, TIA, WIF and PEPE have otherwise all shed over 6%.

- EigenLayer rival Symbiotic’s TVL is up 50% in the past day to $1.56 billion.

- About 47,000 addresses interact with EigenLayer per month, down from 72,000 this time in July and almost 200,000 in June. The number of individuals controlling those addresses is unknown.

- The number of daily Runes transactions has risen by half in the past few days, from around 20,000 to 30,000. BRC-20 transfers have more than doubled to over 72,000.

Ei-gone-Layer

The cringe is back for EigenLayer.

Restaking is meant to be one of Ethereum’s biggest draws. There’s now over 28% of the total ETH supply staked directly to the blockchain, with new records for validator counts every other day.

The popularity of ETH staking has driven the native yield down to 3.21% from over 4.2% in the past year. Stakers can earn additional MEV above those rates, but by design, ETH yields shrink as more supply is locked up.

Liquid staking platforms like Lido and Rocket Pool allow users to tokenize, trade, stake and otherwise mobilize their ETH stakes for potential gain — opening the door to boosting yields beyond the native APR.

EigenLayer, meanwhile, is gunning to reward restakers with additional native yield that’s reliable. Stakers who would’ve normally gone with Lido to receive stETH could instead simply earn additional rewards for providing economic security to other projects built on EigenLayer (which it calls actively-validated services).

That’s been enough for EigenLayer and apps in its orbit like ether.fi, and renzo to eat some of Lido’s lunch.

The pink line shows the percent of the ether supply that’s staked overall, while the shaded areas show the market share of top staking and restaking protocols.

But EigenLayer’s yield functionality isn’t yet live. It could be later this year, but in the meantime, the protocol has been rewarding early restakers with points and an airdrop — the incentives of choice for yield-bearing DeFi apps this cycle.

Sam Kessler and Danny Nelson’s aforementioned report described instances of mutual back scratching between EigenLayer and platforms that utilize it for the benefit of their own users, particularly AltLayer, Ether.fi and Renzo.

Over 30% of EigenLayer’s TVL currently comes from Ether.fi and nearly 9% from Renzo.

The three bold lines show the value of the airdrops that each Eigen Labs employee reportedly received over time, with bitcoin’s performance in the background for scale.

It’s obviously not a good look. Putting aside that nudging blockchain startups to pledge fealty to your employees would smack of cartel behavior, the gaming of airdrops through Sybil attacks is one of crypto’s longest and most painful headaches.

And considering EigenLayer itself heavily restricted recipients of its own EIGEN airdrop (not yet tradable) in May, in a bid to weed out fake users, the whole situation leads to a whole lot of awkward questions, as Katherine outlined above.

It’s too early to say whether this will have any material impact on EigenLayer, the Ethereum staking landscape or the wider crypto space. And based on Kessler and Nelson’s findings, similar stuff is almost certainly happening elsewhere.

We do know that inflows flipped negative for the first time in months after EigenLayer released the EIGEN whitepaper and details of its airdrop snapshot date.

All told, EigenLayer has only lost less than 5% of its total ETH locked since the whitepaper was released.

And its weekly net flows have stayed negative following the report, with rival Symbiotic instead seeing a surge.

For what it’s worth, the price of pre-market EIGEN tokens is up 70% over the past few days on points-trading platform Whales Market.

The vibes may be off, but something tells me the market will soon forget — until the next snafu comes along.

— David Canellis

The Works

- Point72, the Steve Cohen hedge fund, announced a stake in bitcoin miner TeraWulf.

- Coinbase returned to Hawaii, Blockworks’ Ben Strack reported.

- JPMorgan thinks that stablecoin regulations could be problematic for Tether.

- MakerDAO removed WBTC following a vote early Friday, leading to another update in the BitGo-Justin Sun saga.

- The number of hacks this year has only risen slightly despite the bull market environment, a new Chainalysis report shows.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  Stellar

Stellar  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  OKB

OKB  Cronos

Cronos  Monero

Monero  Dai

Dai  Ethereum Classic

Ethereum Classic  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Synthetix Network

Synthetix Network  Zilliqa

Zilliqa  Basic Attention

Basic Attention  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Waves

Waves  Status

Status  Hive

Hive  Lisk

Lisk  Numeraire

Numeraire  Steem

Steem  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Ren

Ren  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  Bitcoin Gold

Bitcoin Gold