XRP’s Bullish Trade Setup Shows Potential for 1:2 Risk/Reward Ratio

Story Highlights

-

XRP’s technical and price action are flashing a strong buy opportunity with a 1:2.5 risk-to-reward.

-

XRP could rise 12% to $0.635, with an ideal stop-loss set below the support level at $0.539.

-

Despite the significant price fluctuations in other cryptocurrencies, XRP remained above this support level.

In the past few days, the overall cryptocurrency market has been there for sideways including top assets such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP (XRP). This prolonged sideways movement has formed a bullish trade setup in Ripple’s native token XRP, with an ideal risk-to-reward ratio.

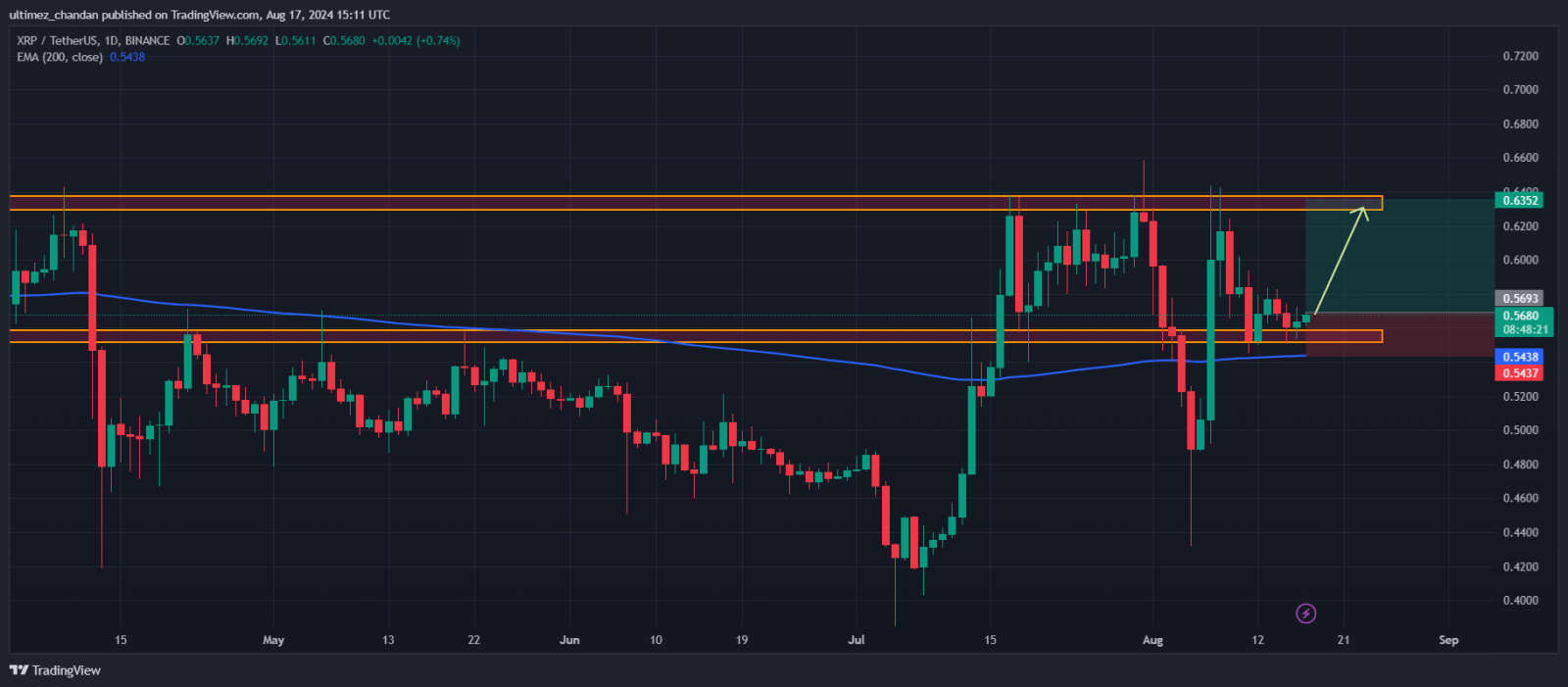

XRP Bullish Trade Setup

Based on the technical and price action analysis, XRP looks bullish as it is at a crucial support level of $0.55 and is forming a bullish inverted head and shoulder price action pattern. Currently, XRP’s daily chart has formed one shoulder and the head, while the other shoulder is in formation. There is a strong possibility that XRP will complete its second shoulder.

This level is flashing a strong buy opportunity with a 1:2.5 risk-to-reward. Based on the price action pattern, XRP could rise 12% to $0.635, with an ideal stop-loss set below the 200 Exponential Moving Average (EMA) and the support level at $0.539.

Despite the recent market crash and significant price fluctuations in other cryptocurrencies, XRP remained above this support level.

XRP Price Overview

At press time, XRP is trading near $0.567 and has experienced a price surge of over 1.35% in the last 24 hours. Additionally, it has experienced a price drop of 5% in the last 7 trading days, according to coinmarketcap.

Meanwhile, XRP’s trading volume has dropped by 45% which hints lower participation from traders and investors in the last 24 hours.

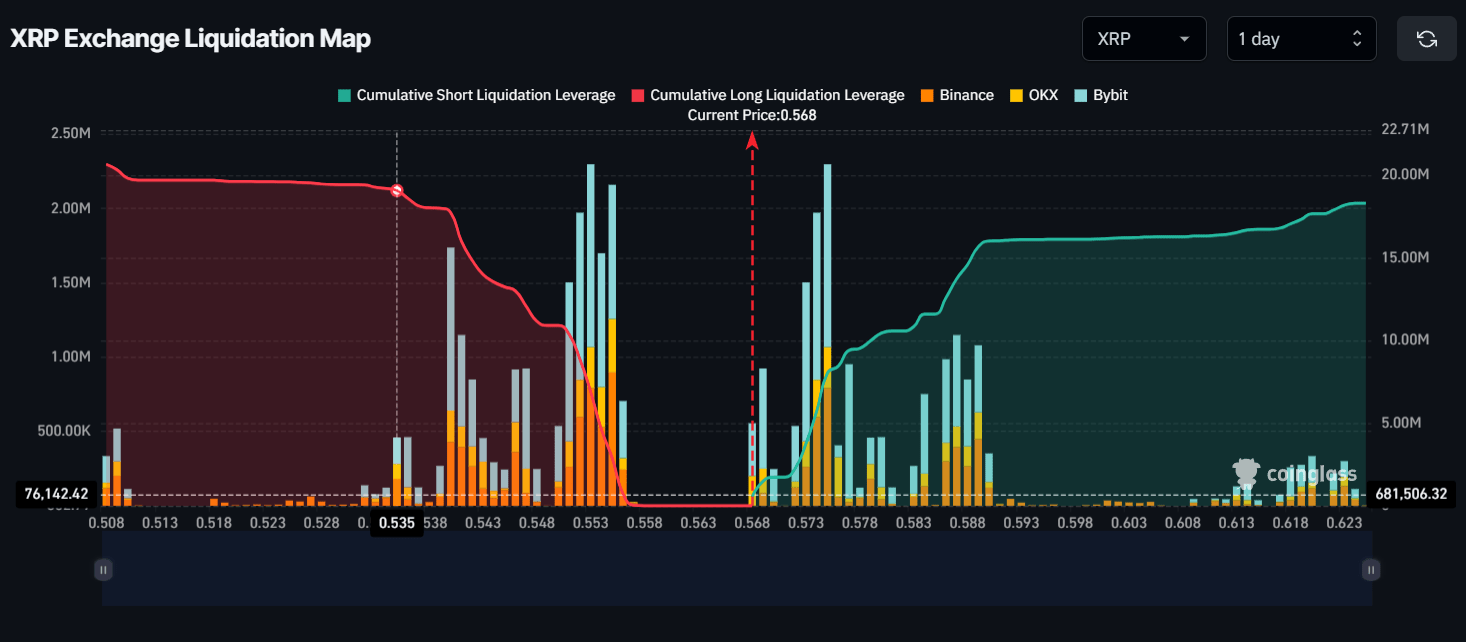

Major liquidation level

As of now, XRP’s major liquidation levels are near $0.553 on the lower side and $0.575 on the upper side, according to the on-chain analytic firm Coinglass. These are the key levels where traders are placing significantly high-leverage bets.

If the market sentiment turns bullish and the XRP price reaches the $0.575 level, nearly $8.04 million worth of short positions will be liquidated. Conversely, if the price falls and reaches to $0.553 level, nearly $6.9 million worth of long positions will be liquidated.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Hedera

Hedera  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  Tether Gold

Tether Gold  IOTA

IOTA  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Basic Attention

Basic Attention  Ravencoin

Ravencoin  Qtum

Qtum  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur