PancakeSwap: how does the famous crypto DEX work?

In this guide we explore step by step the famous crypto DEX PancakeSwap.

It currently ranks 3rd in the ranking of the largest cryptocurrency exchange platforms, given its strong brand and the variety of products offered.

Let’s see how to access the exchange and how to do decentralized trading, and then discover all the more complex additional features.

All the details below

Summary

- The history of the decentralized exchange PancakeSwap

- How to trade crypto on the platform?

- Additional features of the crypto DEX

- PancakeSwap: TVL and on-chain analysis

The history of the decentralized exchange PancakeSwap

PancakeSwap is a DEX (decentralized exchange) that allows the exchange of crypto on multiple blockchains in a trustless manner, without the need for a fiduciary intermediary.

Born in the summer of 2020 as a fork of Uniswap during the enthusiasm for the “DeFi Summer”, it quickly became the leading exchange of the BNB Chain ecosystem.

The infrastructure of facts has been developed under the guidance of Binance precisely with the intention of offering its customers a platform for trading under smart contract.

Over the years PancakeSwap has opened up to other cryptographic networks and today it has as many as 9 support chains including Ethereum, Aptos, Arbitrum, and others.

Over time, the DEX has evolved, adding new features from the simple interface for buying and selling digital tokens.

A few months after its inception, it has attracted many investors and liquidity providers due to the excellent incentives offered on the “liquidity mining” front.

The users basically lent their cryptocurrencies to the platform to facilitate liquidity for trading, and in return, they received rewards.

This practice is still working well today but has lost the FOMO of the early years when practically everyone operated on the DEX.

At the center of PancakeSwap we find the utility token CAKE, with governance and staking functions. Many of the returns offered by the platform are paid in CAKE, and several liquidity pools are anchored to this coin.

Currently, CAKE has a market capitalization of 430 million dollars even though in the past it reached 7 billion.

Source: https://pancakeswap.finance/

How to trade crypto on the platform?

After the initial presentation, let’s now see how to use the crypto DEX PancakeSwap for trading digital coins.

First of all, the first thing you need to do is enter the homepage of the platform and connect your non-custodial wallet.

We find a wide range of supported decentralized wallets, including Metamask, Trust Wallet, Coinbase Wallet, Binance Web3 Wallet, Opera and many others.

Source: https://pancakeswap.finance/

Once connected, we can start trading crypto by going to the “trade” option and selecting one of the available pairs on the DEX.

Unlike centralized exchanges that operate through an order book, decentralized platforms like PancakeSwap use an “Automated Market Maker” (AMM).

This means that various trades are not managed by a buy and sell order book, but are regulated by an equationY*X=K, where Y and X are the prices of the tokens in the pool, and K is the constant of liquidity.

If from the technical side the issue may seem complex for the less experienced, on the practical side doing decentralized trading is really simple.

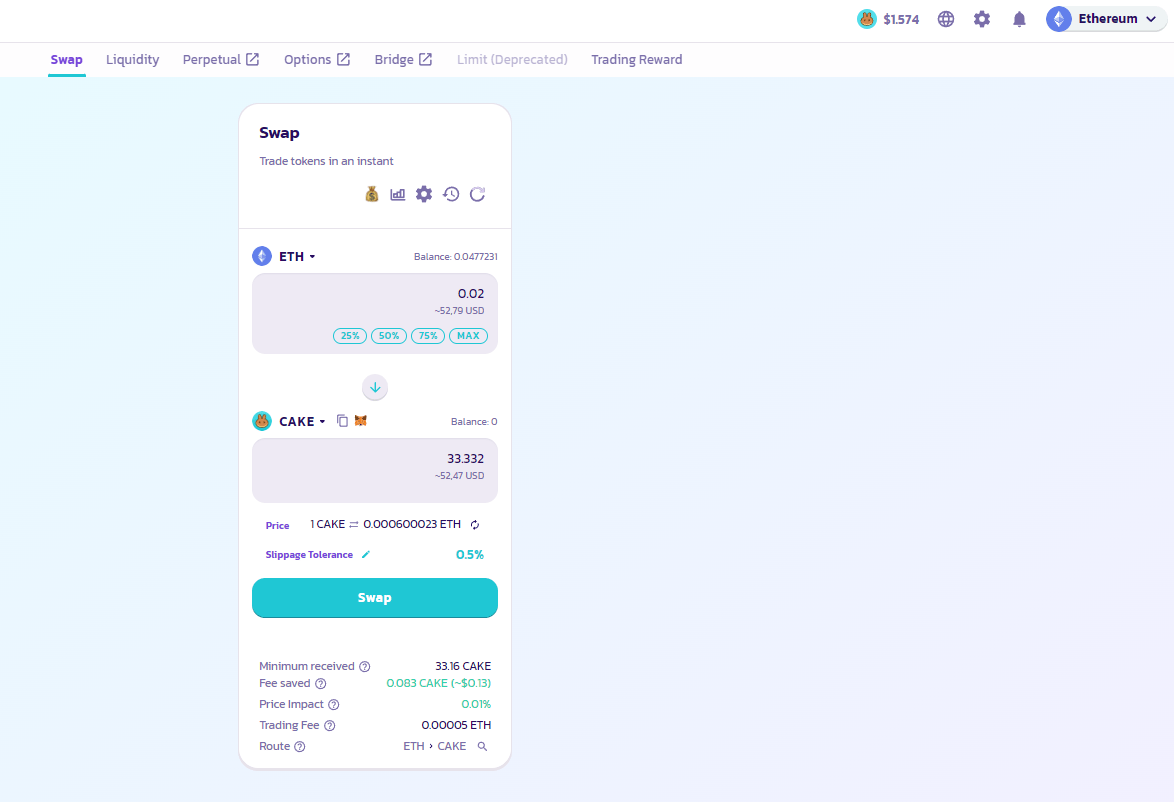

By selecting for example the Ethereum network and choosing the ETH-CAKE pool, we notice how the trading interface is very intuitive.

Just indicate the quantity of ETH you want to sell for CAKE (or vice versa) and PancakeSwap will indicate the quantity of tokens you will receive and the associated fees.

Click “swap” (prior approval if required) and confirm the transaction in the connected decentralized wallet.

Attention: based on the reference chain you will have to pay the due gas fees (for example: on Ethereum you pay with ETH; on BNB Chain with BNB etc.)

We recommend beginners to test the platform with small amounts of capital before starting to operate with large sums of money.

It is also recommended to pay attention to the liquidity present in the smaller pools and avoid trading at high slippage.

Source: https://pancakeswap.finance/swap

Additional features of the crypto DEX

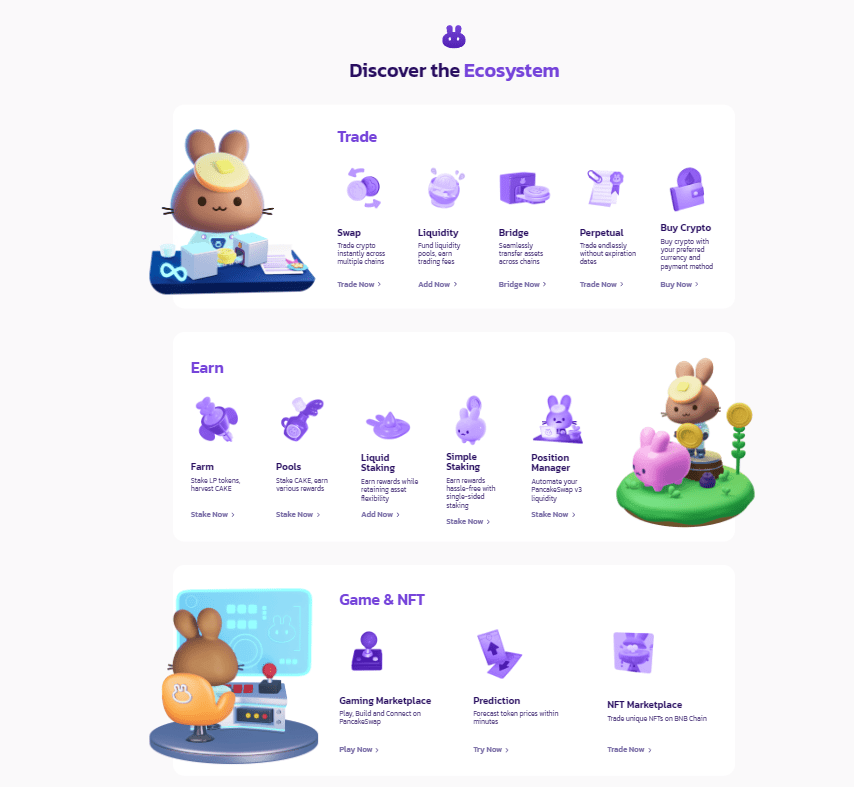

As already mentioned, the DEX PancakeSwap not only allows you to buy and sell crypto, but it offers a wide range of additional features.

With the platform, we can, for example, earn returns on our assets by staking in the various liquidity pools, identified under the item “pools”.

On CAKE for example, there is currently a promo offering up to 25.81% APR as yield, paid in the same deposit token.

Source: https://pancakeswap.finance/cake-staking

If you want to receive returns in CAKE, you can also consider the “farms” section where by adding a liquidity pair you will have an economic incentive

Same goes for the “position manager” feature recently introduced where LP managers rely on a more efficient automated management.

Among the other interesting features offered by PancakeSwap, there is an area entirely dedicated to crypto gaming. Inside it, we find a lottery where users can buy tickets and hope to win the draw prizes. Or a predictions section where one can bet on the short-term trend (bull or bear) of certain tokens.

Very interesting also the “quest” section where simply by completing tasks you earn rewards in crypto.

Source: https://pancakeswap.finance/lottery

Not to forget the presence of a bridge for cross-chain crypto transfers and a platform for perpetual futures or options trading.

From simple functionalities like the “swap”, PancakeSwap thus also integrates a variety of other more or less complex products to use.

This makes the DEX a decentralized platform complete, where you can carry out any cryptographic activity in DeFi.

Source: https://pancakeswap.finance/

PancakeSwap: TVL and on-chain analysis

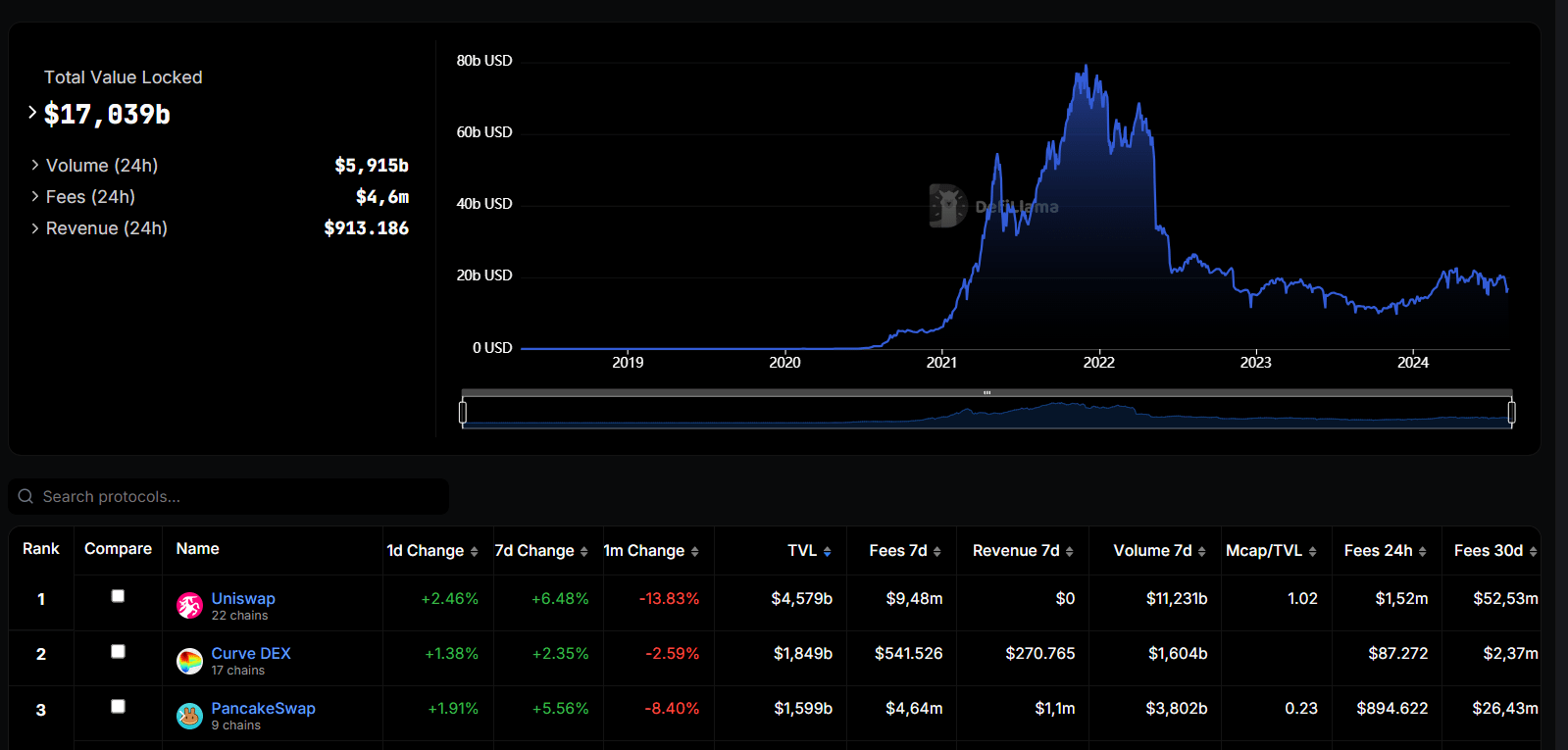

PancakeSwap represents the third largest DEX in the crypto sector for “Total Value Locked” (TVL), behind only Curve and Uniswap.

Overall, according to DefilLama data, the platform contains assets worth 1.59 billion dollars, equal to 9% of the total share of all DEX.

In 2021 it had almost reached the value of 8 billion dollars, but then it saw a loss of ground due to the growth of this sector and the increasingly numerous competitors.

In any case, despite the market share lost over the years, it maintains a good level of revenue. In the last month, it collected fees of 6.5 million dollars, while in March it reached the annual record of 15.5 million dollars.

Also the volumes of trading are interesting, with around 19 billion dollars traded in July and over 43 billion in March.

Source: https://defillama.com/protocols/Dexes

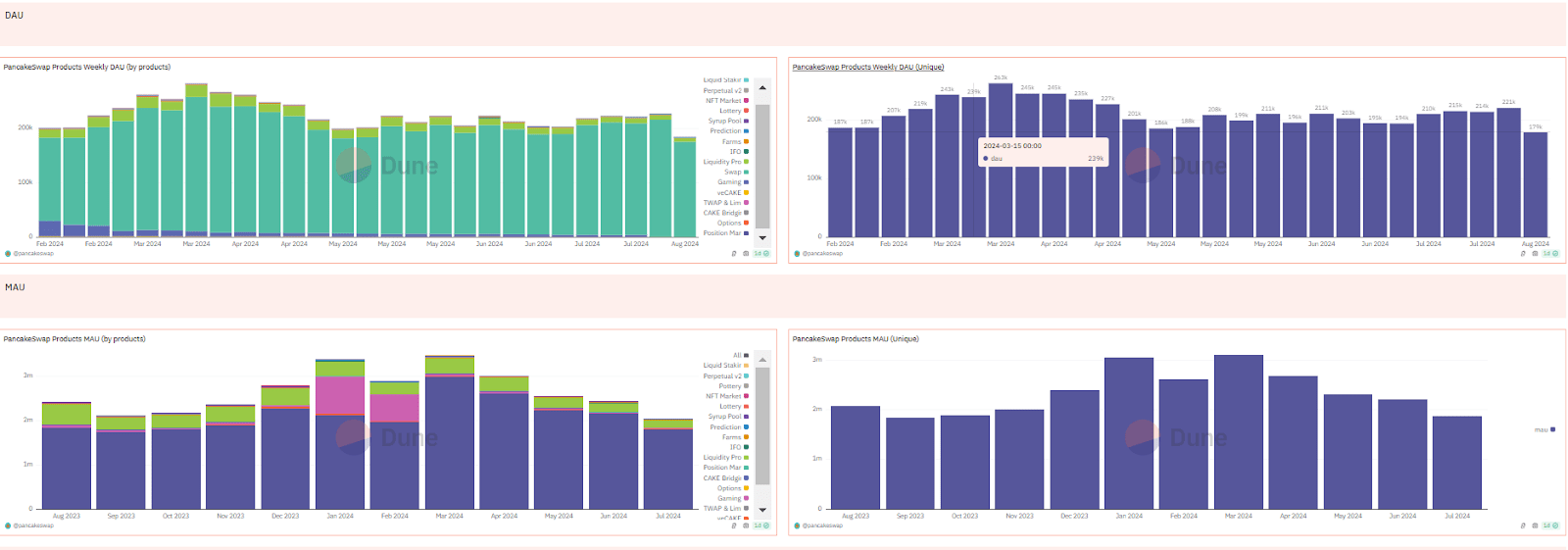

On the on-chain data front, we notice instead how the products of the DEX PancakeSwap are used by users in a more or less stable manner.

Since the beginning of the year, the metric of “product weekly DAU” which identifies the active users daily has shown a level that hovers around 200,000 units each week.

Most of the active users turn to the swap function to exchange crypto, but the prediction, liquidity, and farms functions also have their network traffic.

As for the “product MAU”, which identifies the monthly active users, the numbers become slightly more unstable but remain above 2 million units.

In the month of July, a total MAU of 1.8 million active users

Source: https://dune.com/pancakeswap/pancakeswap-product-users

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Ravencoin

Ravencoin  Polygon

Polygon  Dash

Dash  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD