Nifty 50 index could retest all-time high thanks to these catalysts

Indian stocks continued powering high this month, helped by the rising hopes of Federal Reserve interest rate cuts and a fairly strong rupee. The blue-chip Nifty 50 index rose to ₹24,540 on Monday, up from this month’s low of ₹23,875.

Similarly, the closely-watched iShares India 50 ETF (INDY), which has over $950 million in assets, rose to $54.21 from the August 5 low of $52.10.

Federal Reserve interest rate cuts

The Nifty 50 index has jumped mostly because of the ongoing resurgence of global stocks. In the United States, the Nasdaq 100, Dow Jones, and S&P 500 index have all bounced back and are nearing their highest level on record.

The same trend is happening in other countries in Asia and Europe. In Japan, the blue-chip Nikkei 225 index has jumped by over 25% from its lowest point this month. The German DAX and the French CAC 40 have also bounced back.

This price action is happening as investors hope that the recent jitters on the unwinding of the Japanese carry tradehas ended. Besides, the Japanese yen has eased by over 2.5% from its highest point this year.

Most importantly, there are rising hopes that central banks will save the day. In the United States, there is rising optimism that the Federal Reserve will slash interest rates in its coming meeting in September.

Several Fed officials have confirmed that the bank was considering slashing interest rates later this year. In an interview with the Financial Times, Mary Daly, the head of the San Francisco Fed said that she was supportive of gradual rate cuts. She believes that inflation has now gotten under control.

Her view has been shared by other Federal Reserve officials, including the often hawkish Raphael Bostic. Therefore, the market anticipates a 0.25% interest rate cut in the upcoming meeting in September.

Jerome Powell will likely provide more color about this in the upcoming Jackson Hole Symposium meeting in Wyoming this week.

Reserve Bank of India cuts

Meanwhile, while the Reserve Bank of India (RBI) has remained resistance on rate cuts, most analysts believe that the bank will start cutting interest rates later this year.

RBI’s big concern is that inflation is not falling fast enough. The most recent data showed that the headline CPI eased to 4.75% from the previous 4.8%.

Stock indices like the Nifty 50 do well when the Federal Reserve and local central banks are cutting rates. In most cases, this happens because bond investors rotate to equities as yields fall.

The most recent example of this is what happened at the onset of the Covid-19 pandemic in 2020. At the time, stocks crashed hard and then bounced back as central banks continued their interest rate cuts.

Indian stocks are doing well

The Nifty 50 index surge also happened after the recent election in which Modi won the presidency, albeit at a lower margin than expected. Modi is seen as a more business-friendly president who has focused on improving the country’s infrastructure and appeal to foreign investments.

This trend has helped to push most stocks in the Nifty index higher this year. Bharti Airtel shares have jumped by over 47% this year as the company has continued to gain market share. The rally continued after the company’s founder and biggest shareholder acquired a big stake in BT Grouplast week.

The other top gainer in the Nifty 50 index this year is Bharat Petroleum, one of the top players in the energy industry whose stock has jumped by over 47% this year.

Mahindra & Mahindra and Tata Motors stocks have soared by over 64% and 41% this year. However, the two have pulled back recently after signs emerged that the automobile industry was seeing soft demand. Recent data shows that many auto dealers have inventories of up to 72 days.

The other top companies in the Nifty 50 index this year are names like Adani Ports, Oil & Natural Gas, Power Grid, and NTPC, which have all gained by over 40%.

Additionally, traders are focusing on Trent, the parent company of Zudio, whose shares have more than doubled this year. Analysts believe that it could be the next big inclusion to the Nifty 50 index this year.

Nifty 50 index analysis

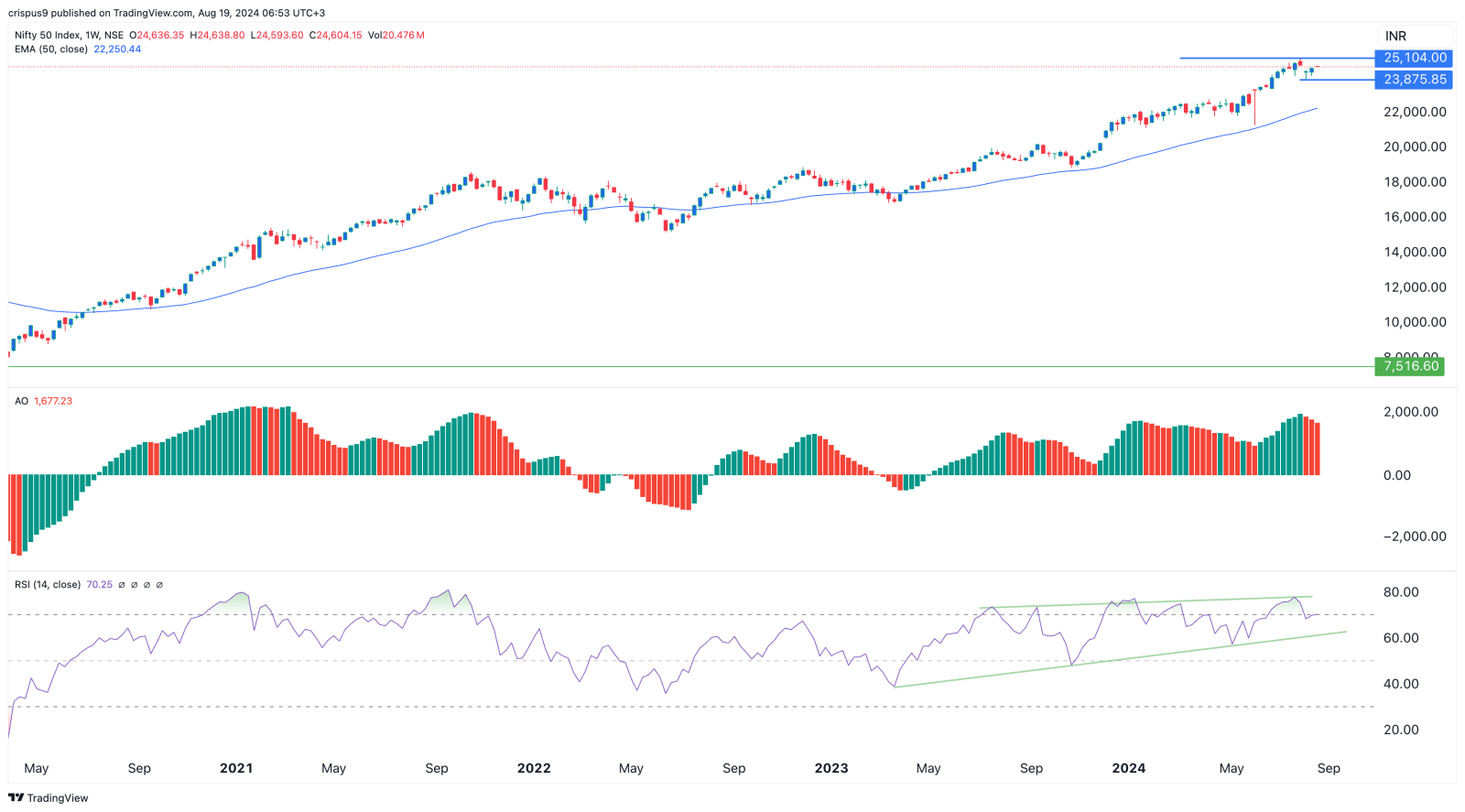

Nifty 50 index chart by TradingView

The blue-chip Nifty 50 index has been in a strong bull run in the past few years. The current phase of the rebound happened after it bottomed at ₹7,516 in March 2020, at the onset of the Covid-19 pandemic.

Since then, the index has been supported well by the 50-week moving average, which is a positive sign. The Relative Strength Index (RSI) has continued rising and formed an ascending channel shown in green. It moved to the overbought point of 70.

Also, the Awesome Oscillator has remained above the neutral point. Therefore, the index will likely continue rising as buyers target the all-time high of ₹25,000, which it reached earlier this month.

The post Nifty 50 index could retest all-time high thanks to these catalysts appeared first on Invezz

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Ravencoin

Ravencoin  Polygon

Polygon  Dash

Dash  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD