Bitcoin (BTC) Price Nears ATH: 5 Reasons It Could Surpass Gold’s Recent Record

- Bitcoin’s strategic withdrawals and growing institutional interest signal potential for surpassing gold’s record.

- Political factors and Fed expectations are key drivers behind Bitcoin’s current price momentum.

According to Coinglass data, strategic withdrawals from major platforms like Coinbase Pro and Bitfinex have led to the accumulation of over 23,000 BTC. Previously, CNF reported that Bitcoin accumulation mirrors 2019 levels, suggesting a $100K parabolic rally is imminent. This has also sparked speculation that certain altcoins are set to explode in price.

In brief, Bitcoin’s price surge is attributed to five key factors:

- Strategic Withdrawals: Over 23,000 BTC were strategically withdrawn from major exchanges like Coinbase Pro and Bitfinex, indicating strong confidence from long-term holders.

- Strong ETF Inflows: Significant investments from institutions like BlackRock and Fidelity have boosted Bitcoin ETFs, reflecting increased investor trust.

- Growing Institutional Interest: Companies like Goldman Sachs and Morgan Stanley are increasingly investing in Bitcoin ETFs, solidifying Bitcoin’s status as a credible asset.

- Political Influence: The U.S. elections are driving market optimism, with pro-crypto candidates contributing to Bitcoin’s positive outlook.

- Fed Rate Cut Expectations: Anticipation of a Federal Reserve rate cut is enhancing Bitcoin’s appeal as a hedge against inflation.

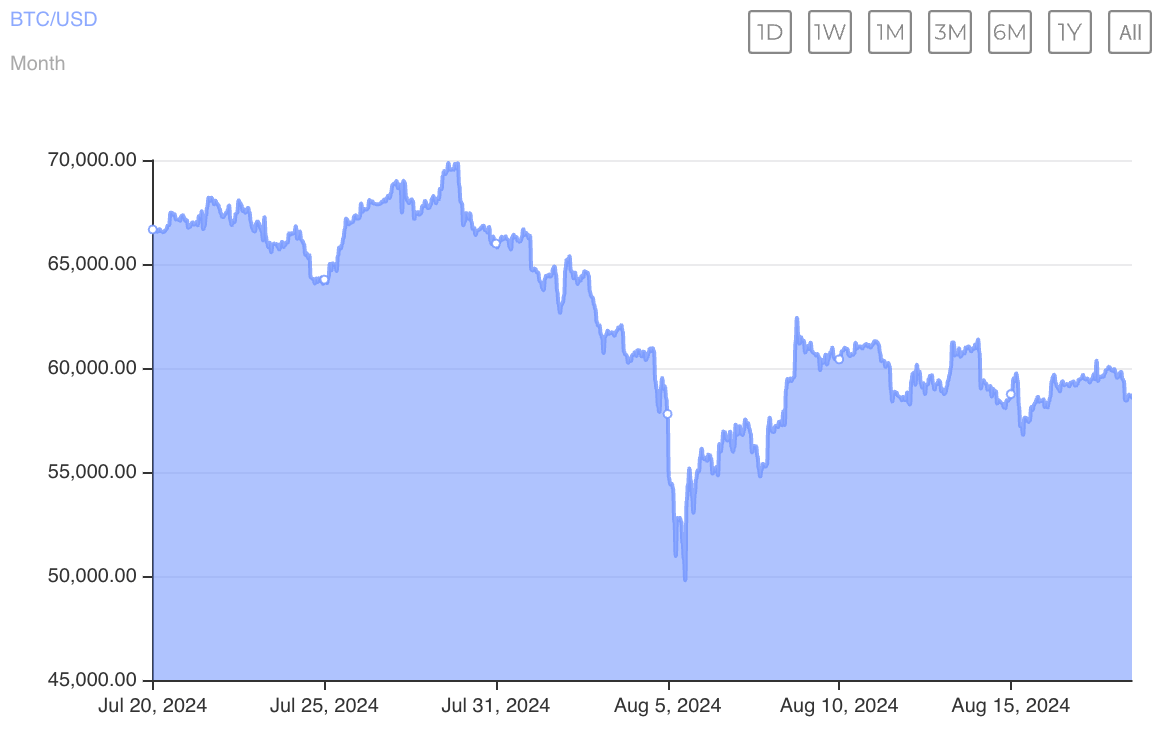

Mirroring previous events, Bitcoin surged past $61,000, fueled by $2.5 billion in stablecoin inflows. In our recent update, institutional investors, including Goldman Sachs, are boosting Bitcoin’s performance with increased activity in spot Bitcoin ETFs. As of now, BTC is trading at $58,723.47, down 1.62% in the past day but up 0.18% over the past week. See BTC Price chart below.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Qtum

Qtum  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Synthetix Network

Synthetix Network  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  BUSD

BUSD  Numeraire

Numeraire  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD  Augur

Augur