USD/ZAR: South African rand rally has no legs, analyst warns

The South African rand continued its strong rally, becoming the best-performing emerging market currencies this year. The USD/ZAR exchange rate retreated to 17.83, its lowest point since August 2023. It has dropped by over 8% from the highest point this year.

Improved business and consumer confidence

The USD to ZAR exchange rate has been in a strong downtrend this year as traders watched the ongoing political stability in South Africa.

This stability happened after the Africa National Congress (ANC) suffered its first election since the end of the apartheid, leading to a coalition government with the business-friendly Democratic Alliance.

This deal has led to more business and consumer confidence, which is expected to lead to foreign capital inflows in the coming months.

Recent data shows that the business confidence index rose to 109.1 in August from the previous 109. While it is still down from its year-to-date highs, it has risen for two consecutive months and analysts expect that the trend will continue.

Additional data shows that the country’s consumer confidence has continued rising in the past few quarters.

As a result, retail sales have risen for four consecutive months, the longest streak since 2022. Sales rose by 4.1% in July from the previous 1.1%.

The rising confidence is also reflected in the performance of South African stocks, which have done well this year. Data shows that the Johannesburg Stock Exchange (JSE) index has jumped to a high of ZAR 82,824, a 10% annual increase, and is sitting at its highest point in years.

Most importantly, inflation has continued falling, with the annual figure falling for all consecutive months since February this year. The most recent data showed that the headline CPI dropped to 5.2% in July from 5.3% in the previous month. Analysts expect the next report to reveal that the CPI moved to 5.0% in July.

SARB rate cuts in 2024

Therefore, this trend has led to the rising expectation that the South African Reserve Bank (SARB) will start cutting interest rates this year.

The central bank has left interest rates at 8.25% in the past eight consecutive meetings and the governor has been resistant to hike them.

As a result, this situation has made the South African rand more attractive since money market funds and the country’s government bonds are providing a higher inflation-adjusted return. A 3-month government bond note was yielding 8.15% on Monday while the 10-year was returning 9.3%.

Additionally, the government has worked to improve its financial position and the Eskom issue. For example, the central bank is now moving over $5.5 billion of its reserve profits to the Treasury Department, a move that is expected to help it reduce government borrowing.

However, not everyone is optimistic that the South African rand rally will continue this year, especially now that the swap market anticipates 0.50% rate cuts this year. In a note, Marek Drimal of Societe Generale said:

“The one-off move higher in USD/ZAR during the market rout in early August offered investors a very good entry point to buy South African assets. It’s unlikely the rand rally has still legs.”

Federal Reserve actions

The USD/ZAR exchange rate has also retreated because of the ongoing Federal Reserve actions. In its July meeting, the central bank left interest rates unchanged between 5.25% and 5.50% for the seventh consecutive meeting.

Most importantly, the bank decided to leave the door open for a rate cut in September. While some analysts are expecting a 0.50% rate cut, most of them believe that it will slash by 0.25% because of the recent strong economic numbers.

The most recent data showed that the US retail sales jumped in July, which is a good sign for consumer confidence. Also, while inflation is falling, it is not retreating at a fast pace. Data released last week showed that the headline CPI fell to 2.9% in July, down from 3.0% in the previous month.

Looking ahead, there will be two important USD news this week: Fed minutes and the Jackson Hole Summit. These events will provide more information on the next Fed meeting.

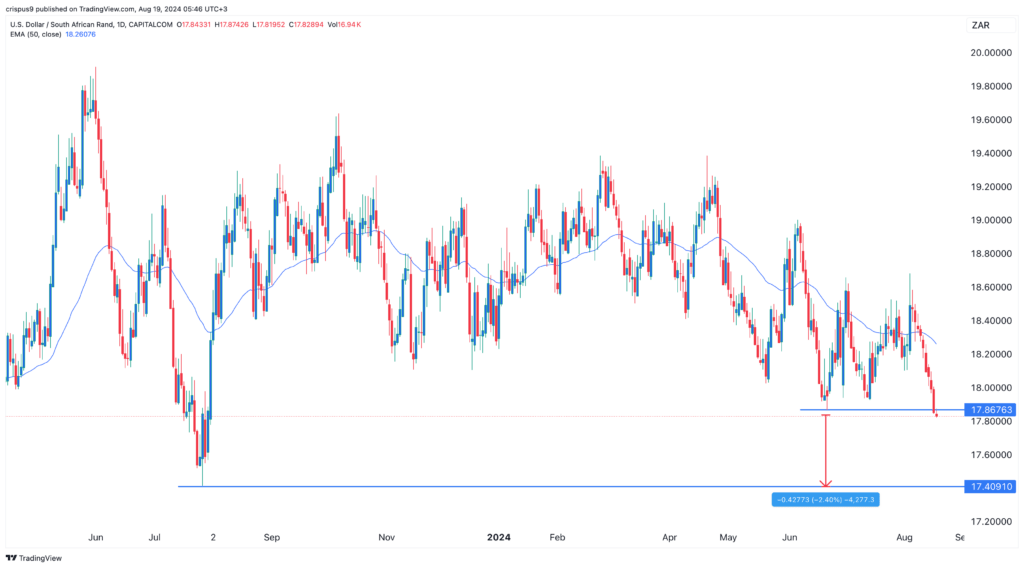

USD/ZAR technical analysis

The daily chart shows that the USD to South African rand has been in a strong downtrend in the past few months. Most recently, it has dropped in the past ten consecutive days, the longest streak in years.

The pair has also dropped below the key support level at 17.86, its lowest point in July this year. It has also crashed below the 50-day moving average, meaning that bears are in control for now.

Therefore, the pair will likely continue falling as sellers target the next support level at 17.40, its lowest point in July. This price is about 2.90% below the current level.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Cronos

Cronos  Stellar

Stellar  Ethereum Classic

Ethereum Classic  Dai

Dai  Stacks

Stacks  Monero

Monero  Hedera

Hedera  OKB

OKB  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Theta Network

Theta Network  KuCoin

KuCoin  Maker

Maker  Gate

Gate  EOS

EOS  Polygon

Polygon  NEO

NEO  Tezos

Tezos  Tether Gold

Tether Gold  Zcash

Zcash  Bitcoin Gold

Bitcoin Gold  IOTA

IOTA  TrueUSD

TrueUSD  Synthetix Network

Synthetix Network  Holo

Holo  Zilliqa

Zilliqa  Dash

Dash  Qtum

Qtum  0x Protocol

0x Protocol  Siacoin

Siacoin  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Enjin Coin

Enjin Coin  Decred

Decred  Ontology

Ontology  NEM

NEM  Lisk

Lisk  DigiByte

DigiByte  Status

Status  Waves

Waves  Nano

Nano  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  OMG Network

OMG Network  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy