Bitcoin Technical Analysis: BTC Faces Continued Downward Pressure

As of August 19, 2024, bitcoin is trading at $58,061, with a 24-hour intraday range between $57,918 and $60,191. The crypto asset saw a trading volume of $20.7 billion and maintains a market capitalization of $1.14 trillion. Multiple timeframes reveal a sustained downtrend, with key resistance levels holding firm and technical indicators signaling weak buying interest.

Bitcoin

Bitcoin’s 1-hour chart paints a grim picture, with a recent sharp decline from $60,271 to $57,844. The drop was marked by a significant increase in volume, suggesting potential capitulation. However, the absence of strong upticks following this decline indicates that buyer momentum remains weak. The price has since entered a consolidation phase, with smaller movements reflecting indecision in the market.

BTC/USD 4-hour chart on Aug. 19, 2024.

The 4-hour chart reinforces the bearish outlook, showing that bitcoin faced substantial resistance at $61,809 before experiencing a sharp sell-off to $56,138. While there was an attempt to recover, the overall trend remains bearish. The volume spike during the sell-off, followed by decreasing volume during the recovery, highlights a lack of strong buying support.

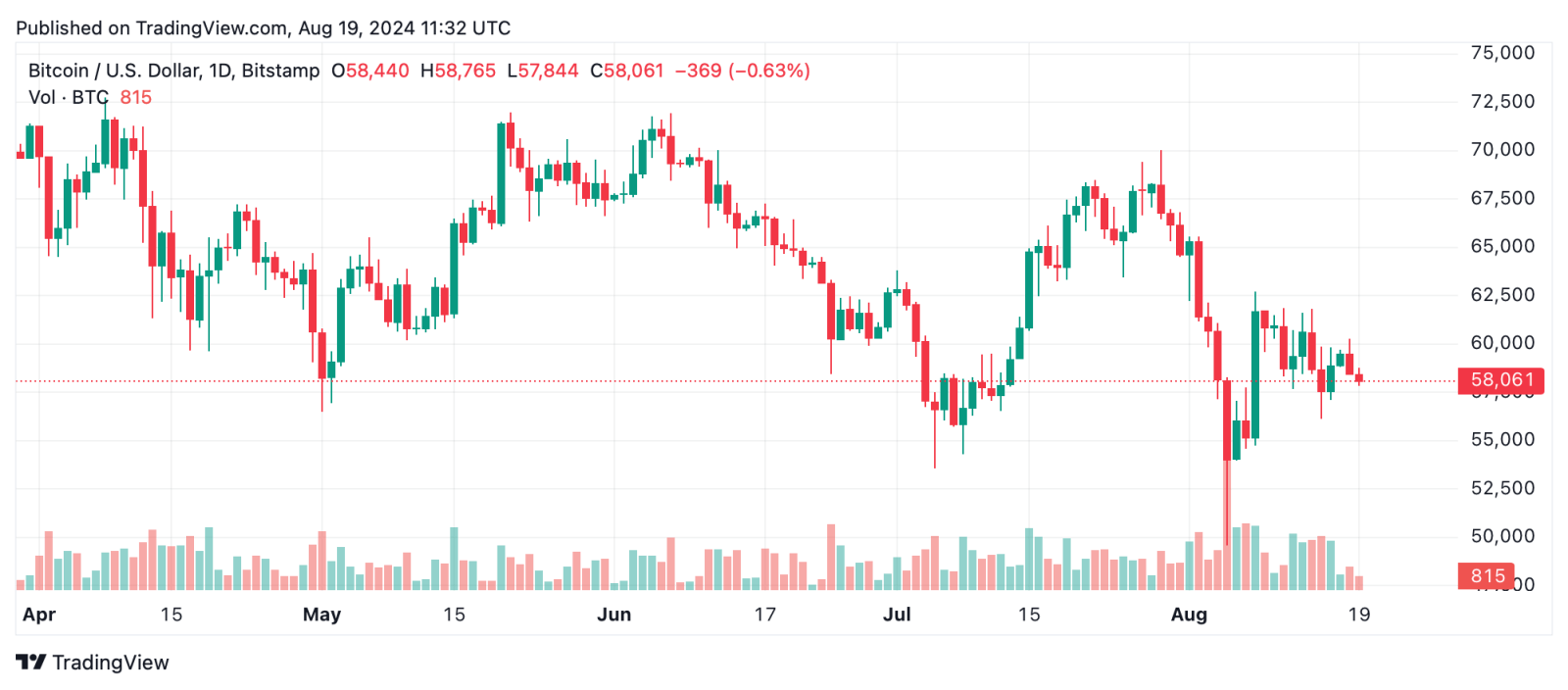

BTC/USD daily chart on Aug. 19, 2024.

On the daily chart, bitcoin’s sustained downtrend since the peak of $70,016 continues, with the latest significant drop bringing the price near $57,800. Volume analysis shows heavy selling pressure, as high volume accompanies the major declines, while the green days see weaker volume, indicating seller dominance.

The oscillator readings further cement the bearish outlook, with the relative strength index (RSI) at 43.8, indicating a neutral zone. The moving average convergence divergence (MACD) level at -1,181.7 gives a sell signal, while other indicators like the Stochastic (63.5) and commodity channel index (CCI) (-45.6) remain neutral. Momentum stands as the lone bullish sign, pointing toward a potential buy signal, though it is not backed by the broader price action.

The moving averages across all timeframes reinforce the bearish outlook for bitcoin. Every significant moving average—whether short-term or long-term—signals a sell. The 10-day and 20-day exponential moving averages (EMAs) are both below current price levels at $58,974 and $59,883, respectively, indicating downward momentum. Even the 200-day simple moving average (SMA), typically a long-term trend indicator, is well above the current price, further suggesting that the bearish trend is deeply entrenched. The alignment of these moving averages underscores the ongoing weakness in bitcoin’s price action.

Bull Verdict:

Despite the prevailing bearish sentiment, the potential for a short-term bounce exists if bitcoin can break above the $58,800-$59,000 resistance with strong volume. Momentum indicators suggest there might be a window for opportunistic buying, especially if a reversal pattern emerges on the daily chart. However, any bullish outlook should be approached cautiously, with tight stop-losses in place.

Bear Verdict:

The overall technical outlook for bitcoin remains firmly bearish across all timeframes. With persistent downward pressure, weak recovery attempts, and key resistance levels holding strong, the probability of further declines is high. Traders should be prepared for continued weakness, particularly if bitcoin fails to reclaim critical support levels or if selling volume increases.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Theta Network

Theta Network  Zcash

Zcash  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Qtum

Qtum  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Synthetix Network

Synthetix Network  Basic Attention

Basic Attention  0x Protocol

0x Protocol  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Nano

Nano  Ontology

Ontology  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  BUSD

BUSD  Numeraire

Numeraire  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  HUSD

HUSD  Augur

Augur