Solana Sees DEX Growth, But It’s Not Enough for SOL Price

On-chain data shows a 400% spike in trading activity on decentralized exchanges (DEXs) powered by the Solana network over the past week.

However, a closer analysis indicates that the increase might not reflect genuine user participation.

Solana‘s DEX Activity: Much Talk About Nothing

The rise in trading volume across DEXes housed within the Solana network is due to the recent explosion of meme coins, particularly those traded on pump.fun. This Solana-based meme coin creation platform has gained popularity in the past few weeks because it allows users to launch these “joke coins” for free.

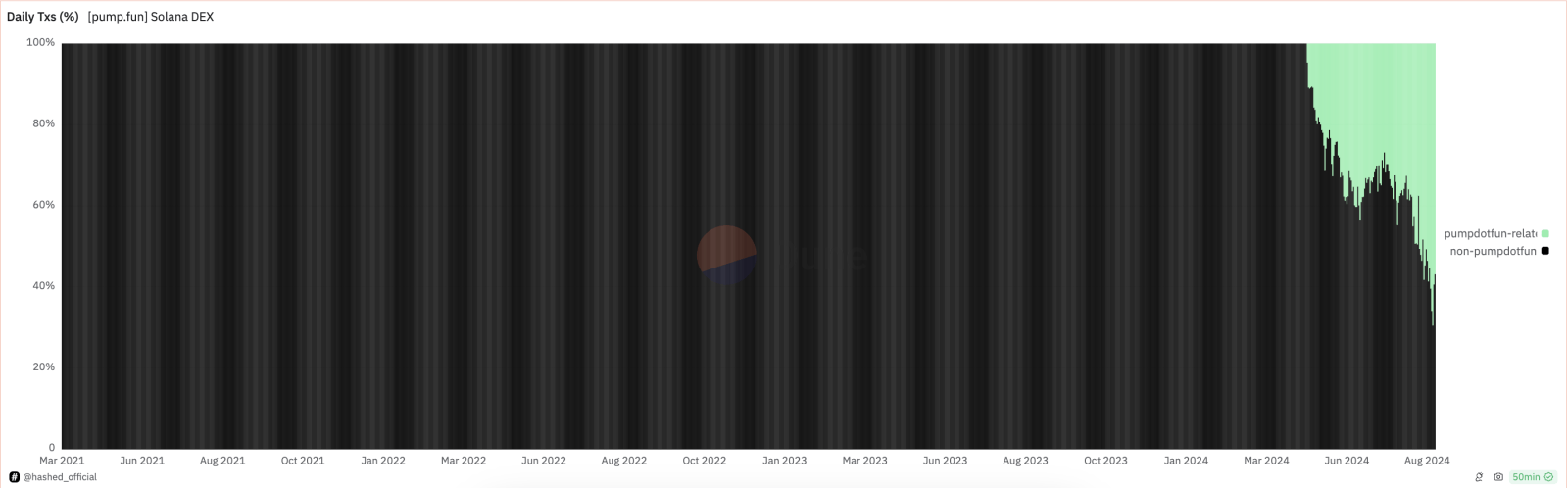

The platform gained significant attention toward the end of June and has since dominated activity across Solana DEXs. Data from Dune Analytics shows that since August, transactions linked to pump.fun have consistently outpaced other activities on these exchanges.

On August 18, for example, pump.fun-related transactions accounted for 70% of all activity on Solana DEXs, leaving only 30% for other transactions. This dominance highlights how the platform has shaped trading dynamics within Solana’s decentralized finance (DeFi) ecosystem.

Solana DEX Transactions. Source: Dune Analytics

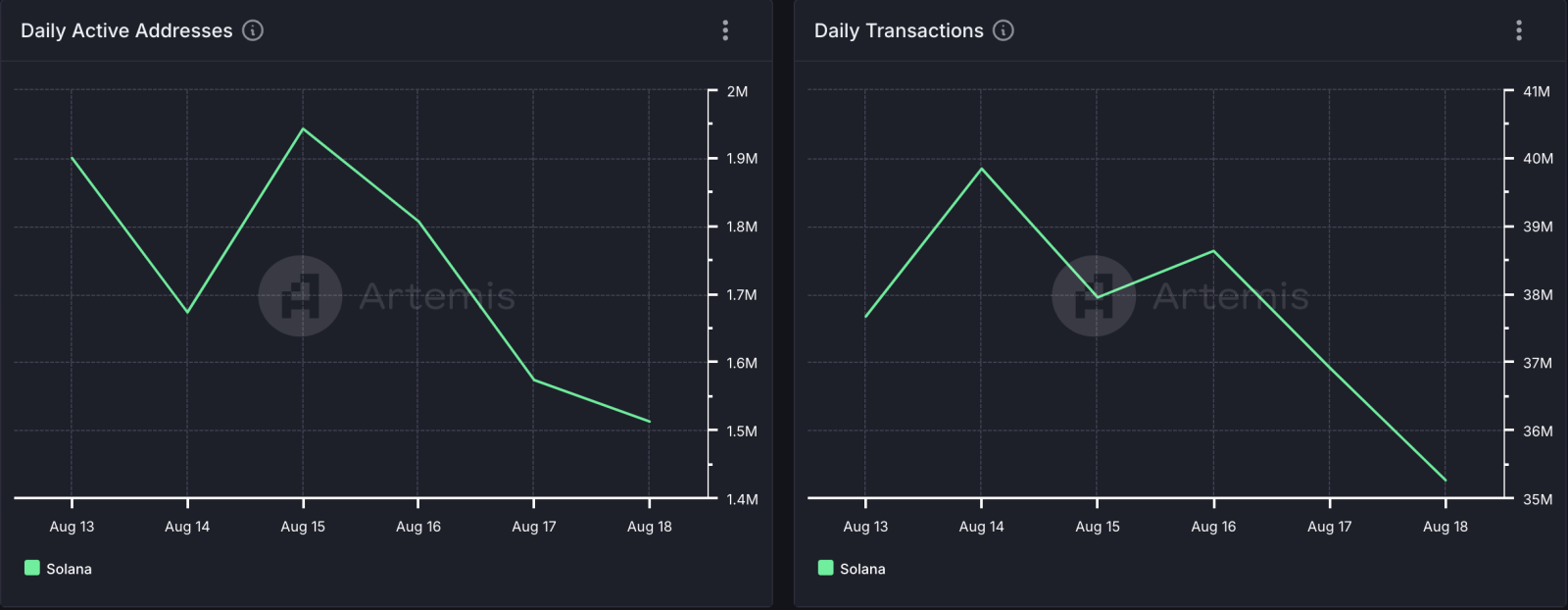

Despite this surge in DEX trading, user activity on the Solana blockchain has not seen a corresponding increase. On the contrary, daily active addresses on Solana have dropped by 20% over the past week.

This decline in users has also led to a dip in the network’s daily transaction count. According to Artemis data, transactions have decreased by 6% in the past seven days.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

Solana Network Activity. Source: Artemis

A primary impact of low user activity and transactions on a network is reduced fees and revenue. During the period in review, Solana’s transaction fees and network revenue have dropped by 34%.

SOL Price Prediction: Trend Begins to Shift

At press time, Solana’s native coin trades at $147.3, with price movements on the one-day chart indicating a possible rally.

Currently, the MACD line (blue) is positioned to cross above the signal line (orange). The MACD indicator tracks changes in price trends, direction, and momentum. When the MACD line crosses above the signal line, it often signals a shift from a bearish to a bullish trend, hinting at a potential short-term rally.

Read more: 13 Best Solana (SOL) Wallets To Consider in August 2024

Solana Price Analysis. Source: TradingView

If SOL completes this crossover and demand rises, its price could reach $148.27. However, if buying pressure diminishes and bearish momentum takes over, SOL’s value could drop to $133.64.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Chainlink

Chainlink  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Stellar

Stellar  Hedera

Hedera  Litecoin

Litecoin  Monero

Monero  Dai

Dai  OKB

OKB  Cronos

Cronos  Ethereum Classic

Ethereum Classic  Gate

Gate  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Algorand

Algorand  KuCoin

KuCoin  Stacks

Stacks  Tether Gold

Tether Gold  Zcash

Zcash  Theta Network

Theta Network  IOTA

IOTA  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Ravencoin

Ravencoin  Polygon

Polygon  Dash

Dash  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Basic Attention

Basic Attention  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Nano

Nano  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  Waves

Waves  Hive

Hive  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Numeraire

Numeraire  BUSD

BUSD  NEM

NEM  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  HUSD

HUSD