Ethereum (ETH) Price Eyes $3,000 as Low Selling Fuels Bullish Momentum

Ethereum (ETH) price could benefit from investors’ change in outlook as they move from selling to potentially buying.

The indications arise from the drop in realized losses, which were at an 11-month high less than two weeks ago.

Ethereum Investor Confidence Could Be Rising

Ethereum’s price could come back from the lows of $2,500 it is currently hovering around. Consolidated under $2,681, the altcoin king has been looking for a breakout, which could come soon.

The reason behind this is the halt in selling. Looking at the realized losses faced by ETH holders in the last three weeks, it can be noted that the July crash created panic. This led to sudden offloading, resulting in sharp losses.

Read more: How to Invest in Ethereum ETFs?

Ethereum Realized Losses. Source: Glassnode

But this has changed considerably in the last ten days, as the price recovered slightly and reinstated the hope of a rise. This is a bullish sign, and the Market Value to Realized Value (MVRV) ratio further fuels this signal.

If ETH holders move to accumulate from here, Ethereum’s price recovery could gain strength.

Ethereum MVRV Ratio. Source: Santiment

ETH Price Prediction: Close to Breaking Out

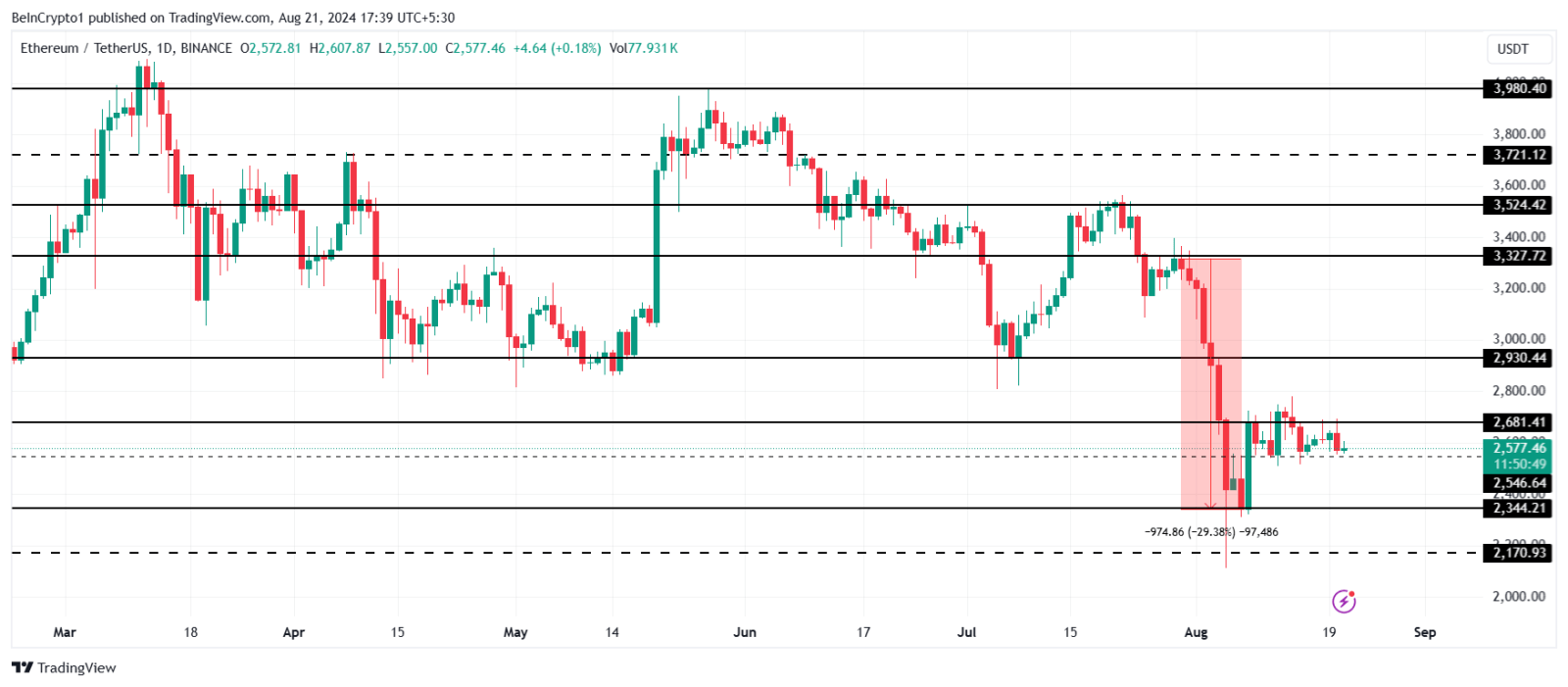

Ethereum’s price at $2,577 is currently stuck moving sideways between $2,681 and $2,546. This short-term consolidation has been holding ETH for the last two weeks.

However, the aforementioned factors point towards a potential breakout from this consolidation. This breach could send ETH rallying toward the next resistance at $2,930, and a rise above this will push ETH to $3,000. A bounce off this resistance could send Ethereum’s price to $3,300, and reaching this point would signal a complete recovery from the July crash.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Ethereum Price Analysis. Source: TradingView

However, if Ethereum’s price fails to breach $2,930, it could enter another consolidation above $2,681. Prolonged sideways action could invalidate the short-term bullish thesis.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur