BTC Price Analysis: Is Bitcoin About to Explode to $64K Soon?

Bitcoin’s price has been holding strong around the $60K level following the significant crash a few weeks ago. Investors are now optimistic that the market will soon rally to new all-time highs.

Technical Analysis

By TradingRage

The Daily Chart

On the daily timeframe, the price has been consolidating during the last couple of weeks after recovering from the $50K mark.

Yet, the 200-day moving average, located around $63K, is yet to be broken to the upside. A bullish breakout above this level is a must for BTC to continue its long-term rally.

On the other hand, if the market loses the $56K support level, things can get worse, as the price will likely drop to $52K and even lower in the short term.

The 4-Hour Chart

Looking at the 4-hour chart, the price has been hovering around the $60K level over the last couple of weeks.

However, it is slowly beginning to make higher highs and lows as the market is seemingly gaining bullish momentum again.

The Relative Strength Index also validates this scenario, as it shows values above 50%. Therefore, a rally toward the $64K resistance level and even higher seems likely in the coming weeks.

On-Chain Analysis

By TradingRage

Bitcoin Exchange Reserve

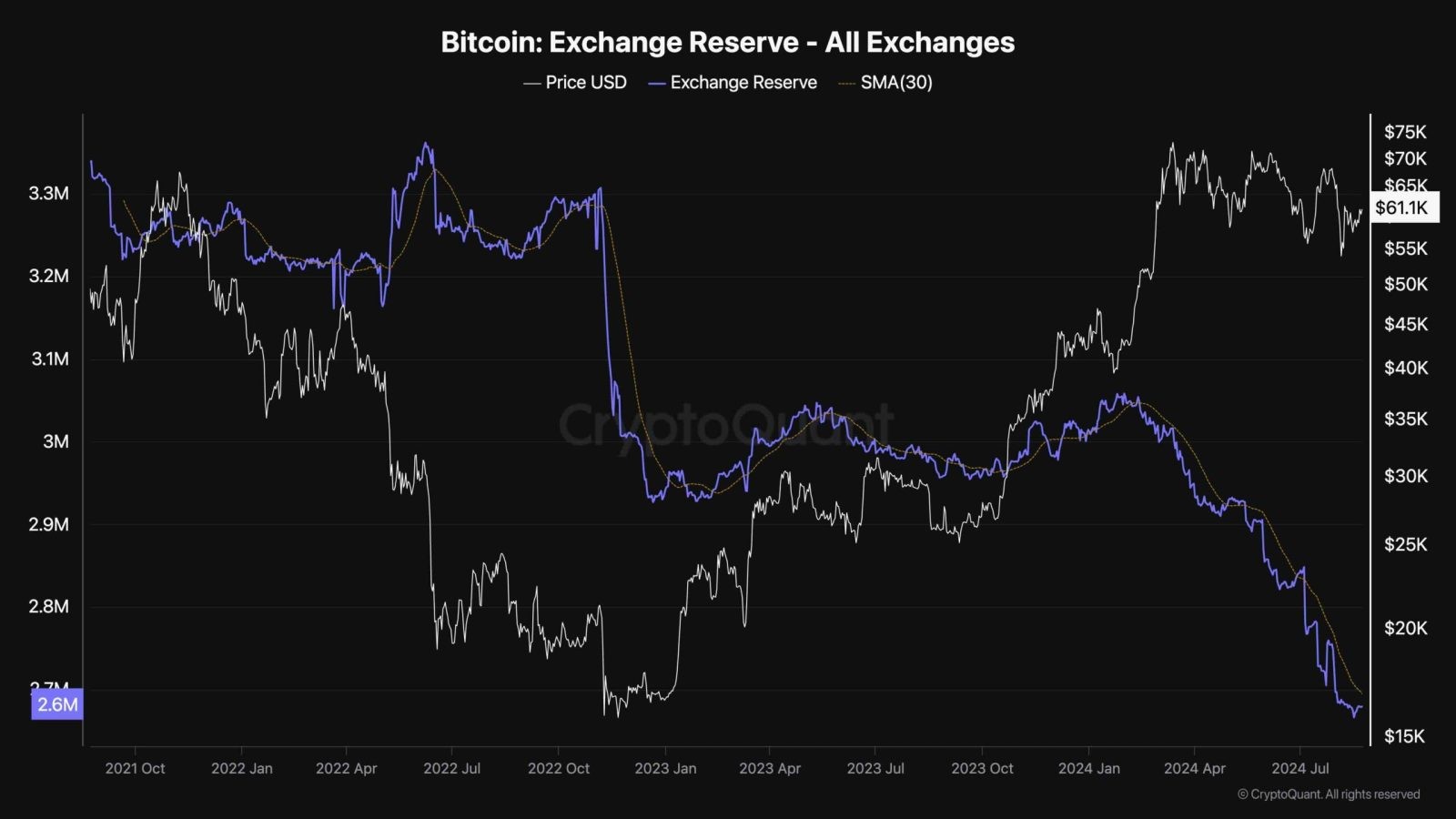

During the recent Bitcoin consolidation and correction, market participants have been wondering whether an accumulation or distribution phase is happening. Analyzing the fundamentals of the network can help answer this question.

This chart demonstrates the exchange reserve metric, which measures the amount of BTC held in exchange wallets. These coins are the most liquid ones and can be a good proxy for supply, as they can be sold in any instant.

As the chart shows, the exchange reserve has been on a steep decline during the recent price consolidation, indicating that the investors are looking at this phase as a temporary correction before a longer-term rally. This aggregate accumulation can lead to higher prices soon if nothing changes drastically.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Hedera

Hedera  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Litecoin

Litecoin  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  Algorand

Algorand  OKB

OKB  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  IOTA

IOTA  Theta Network

Theta Network  Tether Gold

Tether Gold  Zcash

Zcash  Tezos

Tezos  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Dash

Dash  Decred

Decred  Zilliqa

Zilliqa  Qtum

Qtum  Basic Attention

Basic Attention  Synthetix Network

Synthetix Network  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Pax Dollar

Pax Dollar  Numeraire

Numeraire  BUSD

BUSD  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond