Buterin’s 2020 Prediction Fails: XRP Thrives Despite SEC Battle

Back in December 2020, Ethereum co-founder Vitalik Buterin took a jab at Ripple’s legal defense. He singled out their claim that XRP shouldn’t be considered a security for “public policy reasons,” specifically because Bitcoin and Ethereum were supposedly “Chinese-controlled.”

Looks like the Ripple/XRP team is sinking to new levels of strangeness. They’re claiming that their shitcoin should not be called a security for *public policy reasons*, namely because Bitcoin and Ethereum are “Chinese-controlled”. 😂😂https://t.co/ts02JqrTrB pic.twitter.com/mKwEzGIetk

— vitalik.eth (@VitalikButerin) December 22, 2020

This was part of a larger back-and-forth. Ripple CEO Brad Garlinghouse had criticized the SEC for being out of sync with other G20 nations and the broader U.S. government for allegedly favoring Bitcoin and Ethereum, arguing it unfairly benefited China.

Fast forward to August 7, 2023. A U.S. court held Ripple liable for over $125 million in penalties, ordering them to pay the SEC within 30 days. This decision came after both Ripple and the SEC filed competing motions; a significant reduction from the SEC’s initial pursuit of $2 billion in fines.

Despite the substantial penalty, Ripple’s CEO, Brad Garlinghouse, described the ruling as a “victory for Ripple, the industry, and the rule of law.” He emphasized that the court’s decision to lower the SEC’s proposed penalty was a positive outcome. Additionally, Ripple’s Chief Legal Officer, Stuart Alderoty, stated that the company would “respect the $125 million fine” imposed by the court.

The SEC asked for $2B, and the Court reduced their demand by ~94% recognizing that they had overplayed their hand. We respect the Court’s decision and have clarity to continue growing our company.

This is a victory for Ripple, the industry and the rule of law. The SEC’s…

— Brad Garlinghouse (@bgarlinghouse) August 7, 2024

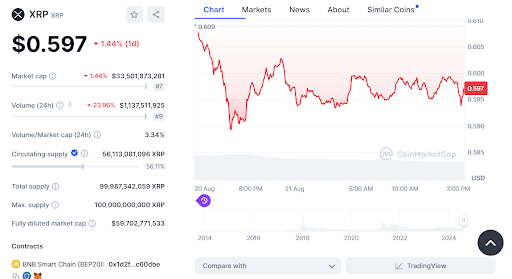

XRP’s price has reacted to the ongoing legal developments. As of the latest data, XRP is trading at $0.597292, down 1.88% in the last 24 hours, with a 24-hour trading volume of $1,119,444,948. XRP’s market cap stands at $33,515,917,774, with a circulating supply of 56,113,081,096 XRP coins.

Moreover, the XRP chart shows potential support levels around $0.59 and $0.60. These levels have served as important support areas in the past, suggesting they could act as near-term price stabilizers.

Source: TradingView

Bitcoin and Ethereum have also experienced slight declines. Bitcoin is currently priced at $59,388.25, down 1.95% in the last 24 hours, while Ethereum is trading at $2,578.69, down 2.60% during the same period.

Ripple’s legal battles continue to reverberate throughout the crypto market. The outcome could shape the regulatory landscape for other cryptocurrencies. It is a far cry from the days when XRP’s defense hinged on claims about Bitcoin and Ethereum’s ties to China. In 2024, XRP is charting its own course, with its legal wins and challenges directly impacting its price and market perception.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur