Crypto tax evasion lands Ukrainian blogger in $5m trouble

Ukrainian financial detectives have charged a local blogger with $5 million in tax evasion through crypto transactions linked to online affiliate marketing.

The Economic Security Bureau of Ukraine has charged a prominent local blogger with evading more than $5 million in taxes through a sophisticated scheme involving crypto transactions, according to an Aug. 16 press release.

The financial intelligence agency says the blogger, known for his involvement in web traffic arbitration and affiliate marketing, orchestrated a complex operation to conceal substantial income generated from various online industries, including gambling, dating, betting, and health products.

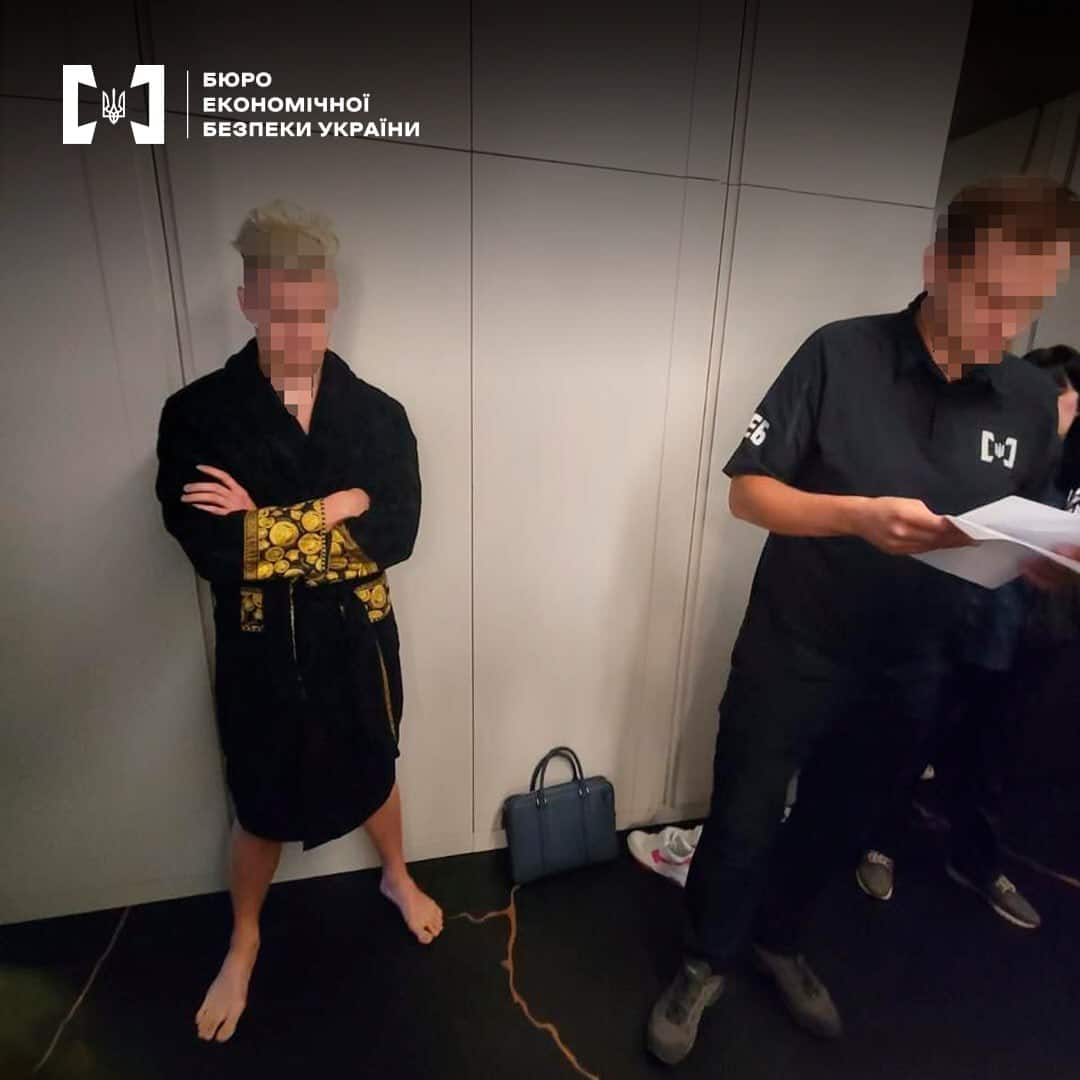

A suspect during the raid | Source: The Economic Security Bureau of Ukraine

While the bureau has not officially disclosed the blogger’s identity, local media reports indicate that the charges are likely directed at Oleksandr Slobozhenko, a well-known figure in Ukraine’s IT and influencer community.

You might also like: The dual edges of cryptocurrency in the Ukraine-Russia war | Opinion

Over $5 million in unpaid taxes

The bureau alleges that the blogger established a commercial entity in 2020 without registering it as a legal business, thereby circumventing tax obligations. Despite the company’s financial success, it was never registered with Ukrainian tax authorities, and no formal employment contracts were signed with its employees, according to the press release.

To further obscure the income, the blogger and his associates converted the profits into crypto using digital wallets registered to trusted individuals.

“Trusted associates of the suspect registered cryptocurrency wallets using their personal data and documents, receiving cryptocurrency payments for the company’s traffic arbitration services. The virtual assets were then transferred to the company director’s electronic wallets and exchanged for U.S. dollars.”

The Economic Security Bureau of Ukraine

The investigation revealed that the blogger’s operations, supported by several IT specialists, resulted in undeclared income exceeding ₴1 billion (around $27 million). None of this income was reported to tax authorities between 2020 and 2023, leading to an estimated $5.1 million in unpaid taxes.

As part of the ongoing investigation, detectives conducted multiple raids, seizing assets that included eight luxury vehicles, apartments, and other properties located in Kyiv. The blogger now faces charges under Ukrainian law for large-scale tax evasion and money laundering.

Read more: IMF urges Ukraine to complete crypto regulation update by end-2024, official says

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur