Ethereum Earnings Falls 57%—But There is a Catch

If we viewed Ethereum from a corporate lens, what type of firm would it be?

Looking at the most recent data at hand, the figures would point to a corporation in crisis: In Q2 2024 Ethereum’s revenue fell drastically by 57% as fees decreased $679 million.

But is there something else more important at hand or is this truly a symptom of failing? Let’s explore the numbers and the background to grasp the real state of Ethereum’s ecosystem.

Ethereum’s latest performance appears to be negative on first look. Originally $1.2 billion in Q1 2024, revenue dropped to $521 million. Given the amazing 85% quarter-over-quarter gain in revenue Ethereum had in Q1 2024, this decline should set up alarms. Ethereum grabbed $1.2 billion in transaction fees during that time, up 155% year over year.

In the first quarter of 2024, the price of Ethereum soared above $3,000, which was close to its all-time high. During that time, some users paid over $100 per transaction. The average gas fee for ETH swap was about $79, and some users reports said fees could go as high as $400 in February.

400 fucking dollars to migrate .1 ETH to Blast mainnet.

It’s so over.

Pack it up. Ethereum is unusable today. pic.twitter.com/hZRrwRAMlz

— Pop Punk (@PopPunkOnChain) February 29, 2024

It was a time of rapid growth, but there were also some growing problems within the ecosystem.

The Impact of EIP-4844 Upgrade

What changed in the second quarter? The launch of Ethereum Improvement Proposal (EIP) 4844 in March 2024 was a major cause. The upgrade implemented ‘protodanksharding,’ which introduces a temporary data blob to reduce Layer 2 transaction fees.

This update rendered Layer 2 (L2) options much more scalable, which means they can now handle more transactions for a lot less fees.

This shift was akin to a small business suddenly gaining access to wholesale prices—more capacity, and lower costs, but also lower immediate revenue.

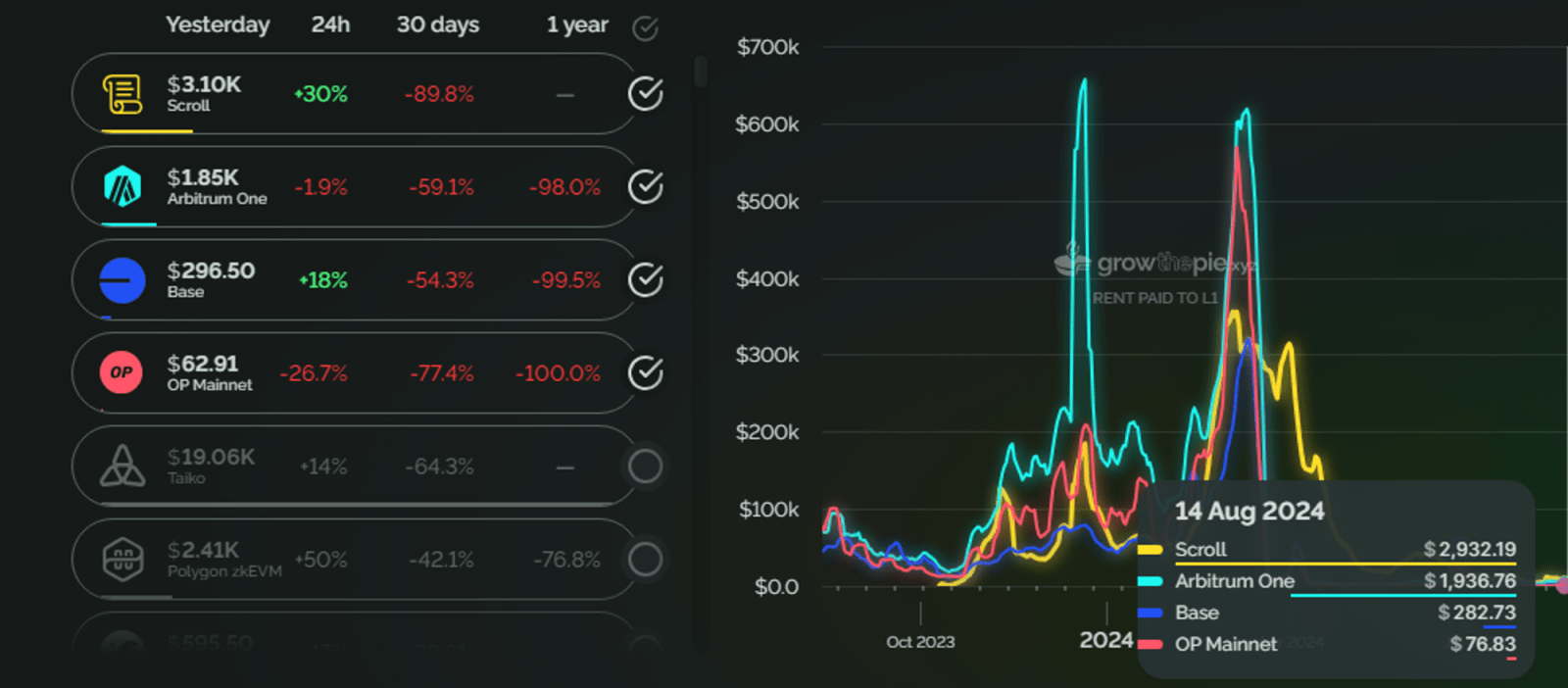

But here’s the catch: although L2s such as Base and Arbitrum are doing very well, the “rent” they pay to Ethereum has dropped considerably. This drop in income is not a sign of weakness; instead, it means that the ecosystem is getting stronger and can handle more growth in the future.

Rent Paid to L1,Source: Growthepie

With lower fees and greater capacity, Ethereum is now positioned to attract a broader user base and encourage more activity on the network.

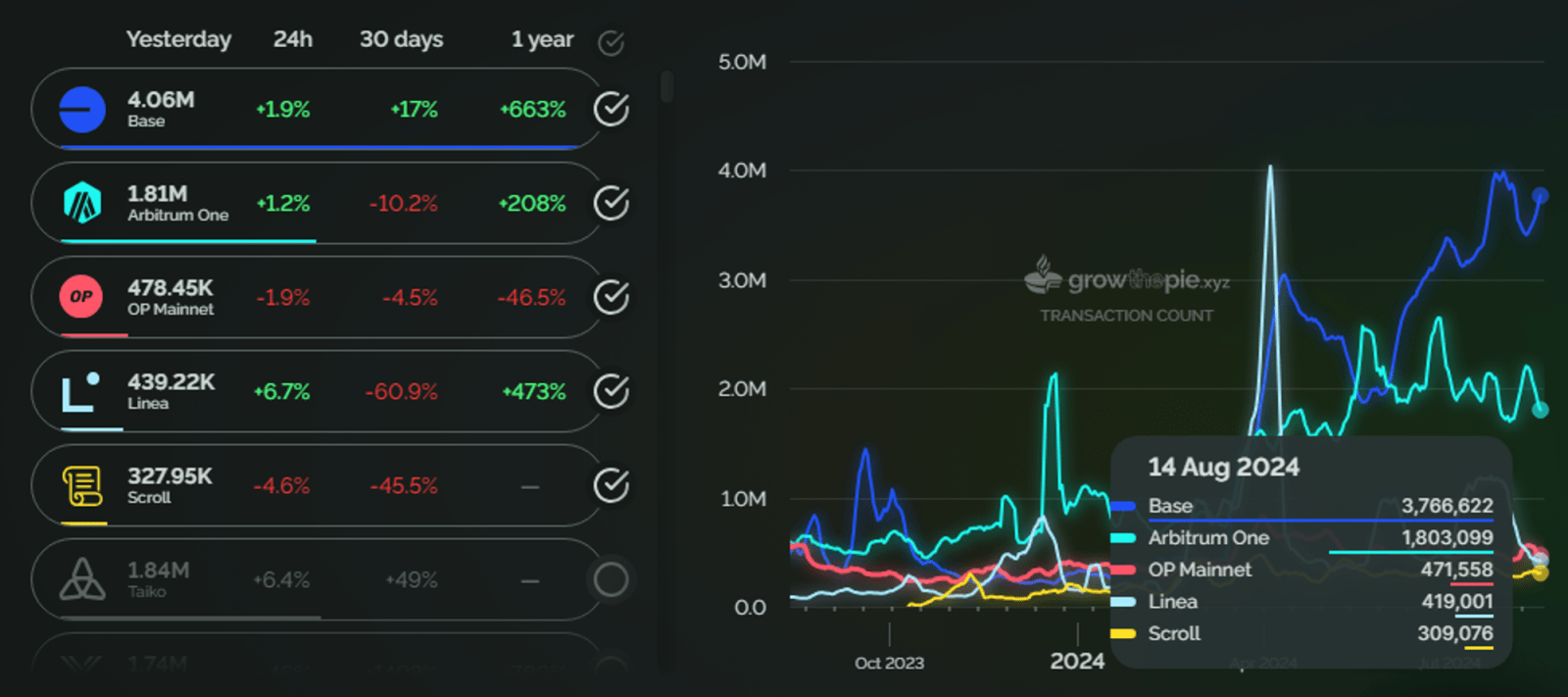

Despite the revenue decline, there are clear signs that Ethereum is on the right track for long-term success. In Q2 2024, Layer 2 transactions surged by 63%, and active users increased by 81%.

Transactions Count, Source: Growthepie

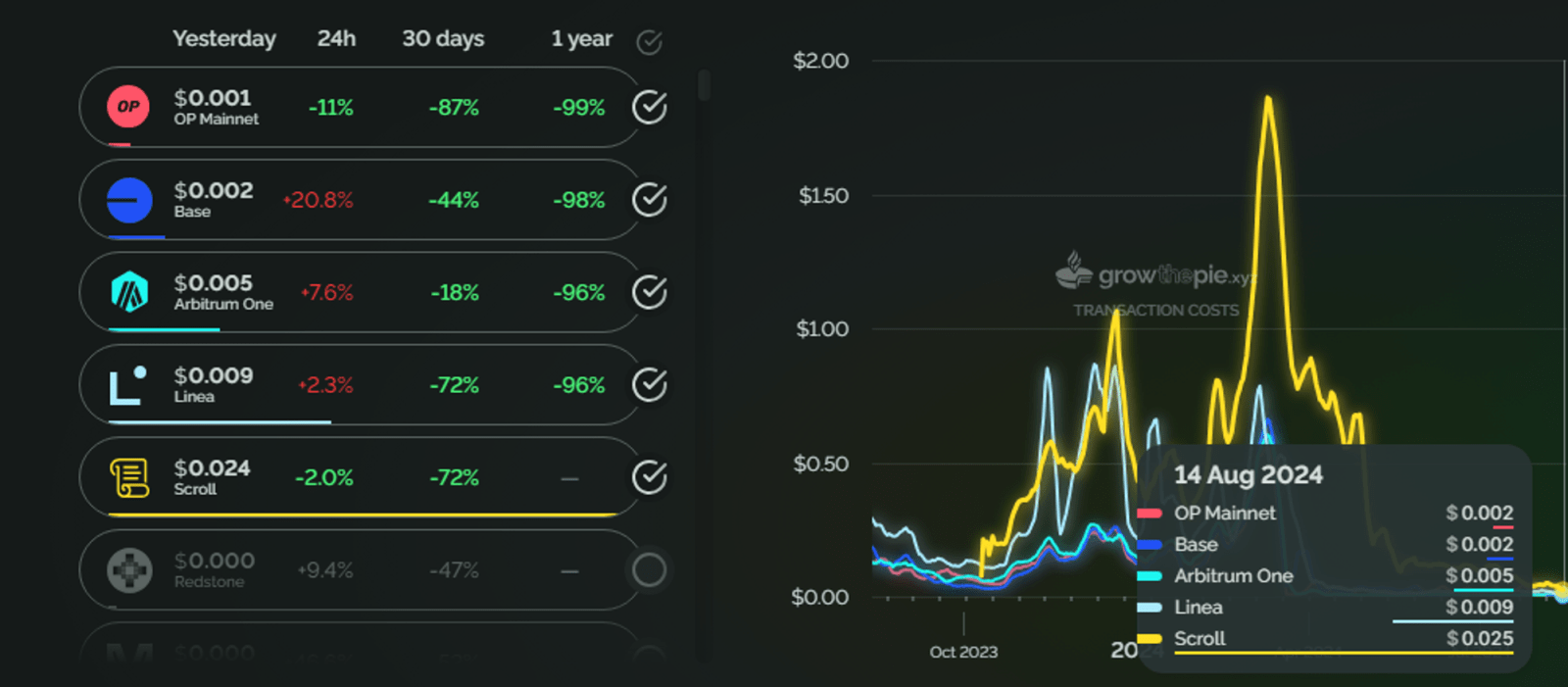

Moreover, the reduction in transaction fees is making Ethereum more accessible to everyday users. As of Q2 2024, the estimated gas fees for various transactions have dropped significantly: a swap transaction now costs around $1.82, borrowing fees are at $1.52, NFT sale fees are $3.12, and bridging costs are just $0.60.

L2 Transaction Costs, Source: Growthepie

This affordability is likely to drive further adoption and usage, laying the groundwork for a future revenue resurgence.

The Bigger Picture: Ethereum’s Broadband Moment

Ethereum is going through the same things that the internet did when it was first introduced. In the early days of the internet, dial-up access made it challenging to do certain things on the internet. But as internet technology evolved, fresh possibilities like streaming and social media emerged.

Similarly, Ethereum’s improved ability to handle transactions is setting the stage for future growth. Ethereum isn’t going away; the foundation is being built for something much bigger.

Look at the internet today—it’s hard to imagine a world without it, yet its full potential was only realized years after broadband became widely available. Ethereum is at a similar crossroads. However, it wasn’t until broadband became widely available that it reached its full potential.

Even though it means less money coming in for now, the increased capacity is necessary for future improvements that will help the ecosystem grow.

Notably, Ethereum’s success in the first quarter of 2024 was partly due to higher transaction fees caused by high network demand. But depending on high fees to make money is not a good long-term plan. By lowering costs and increasing scalability, Ethereum is setting itself up for a more robust and diverse revenue stream in the future.

The numbers from Q2 2024 may seem scary at first, but they show that the network is getting ready for the next stage of its growth. The short-term drop in Ethereum’s income is part of a long-term plan to make the network more scalable, cheap, and easy to use.

The real question isn’t whether Ethereum will recover, but how quickly it will capitalize on its expanded capacity to drive the next wave of innovation and adoption in the crypto space.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur