Ethereum Price Analysis: Is ETH at Risk of $2,500 Reversal?

Ethereum price has retraced 6.83% in the last 24-hours after hitting $2,770 on Aug 14, market data shows how bearish headwinds from SHORT traders nullified the dovish US CPI impact.

ETH Price Tumbled 6.8% in 24 Hours

August began with uncertainty for Ethereum, but the price experienced steady upward momentum in the past week, largely attributed to Grayscale. The US-based investment firm sparked increased market demand after it announced the launch of new cryptocurrency trusts for SUI, TAO, and MKR.

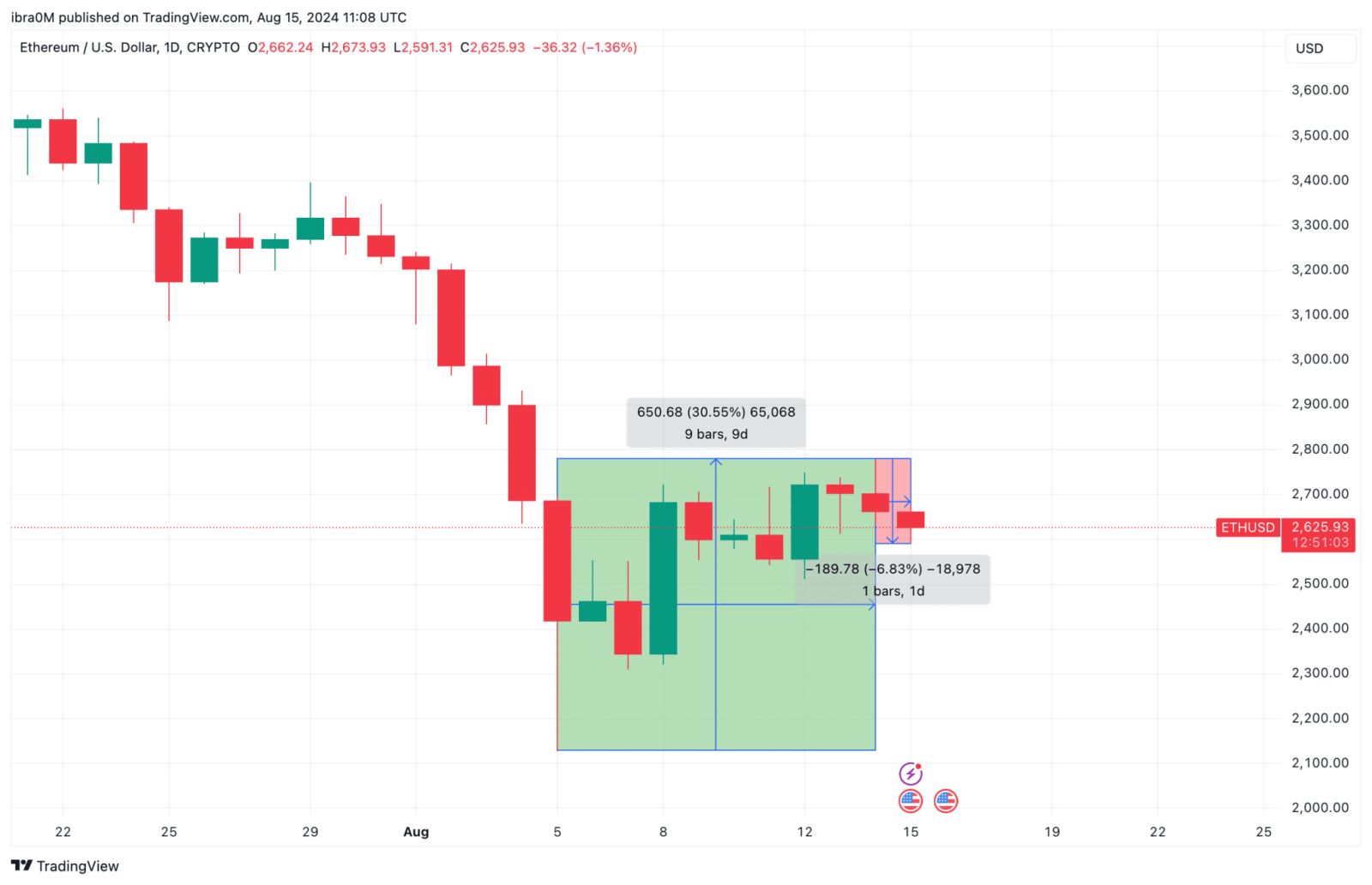

This development, dated August 5, sparked optimism among investors, who saw it as a sign of deepening institutional adoption of crypto. This bullish sentiment extended to ETH, driving the price up by 30% between August 5 and August 14, as reflected in the chart.

Ethereum Price Analysis ETHUSD | TradingView

However, the release of dovish U.S. CPI data on August 14 shifted market dynamics. The initial optimism faded as investors turned their attention to the stock markets, causing a significant decline in cryptocurrency prices. The ETH price fell by 6% within 24 hours, erasing a large portion of its recent gains. The chart above shows how Ethereum stumbled as a result, with concerns mounting over a potential sharp correction in the coming days.

The market’s reaction suggests that Ethereum could now face increased bearish pressure, with derivatives markets hinting at further downside risks.

Short Traders Nullified the Dovish CPI

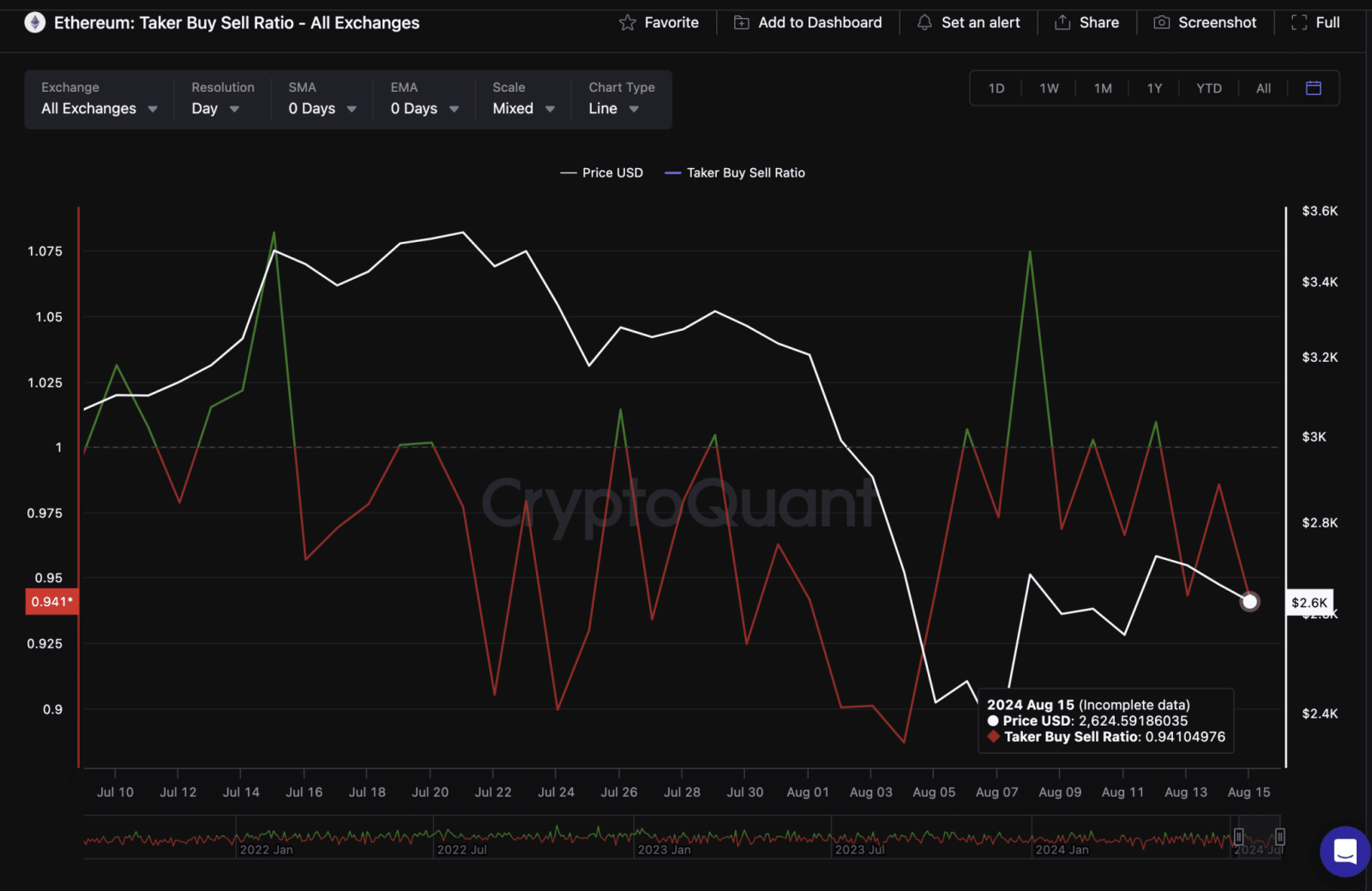

The initial optimism surrounding the CPI data was short-lived as bearish sentiment began to dominate Ethereum’s derivatives markets. A key indicator of this shift is the Taker Buy/Sell Ratio, which measures the ratio of buy orders to sell orders in the market.

The chart above illustrates how the Ethereum Taker Buy/Sell Ratio dropped significantly, from 1.07 on August 8 to 0.94 by August 14.

Ethereum Price vs ETH Taker BuySell Ratio | CryptoQuant

This shift signals a growing bearish sentiment among derivatives traders, who are increasingly betting against Ethereum. The decline in the ratio typically indicates that sell orders are outpacing buy orders, which is a bearish signal for the market.

Despite the dovish CPI, traders remain skeptical about Ethereum’s short-term prospects, suggesting that the recent rally might be unsustainable. With bearish sentiment prevailing in the derivatives markets, Ethereum’s price could potentially dip toward $2,500 in the coming days.

Ethereum Price Forecast: Bears Could Force a $2,500 Reversal

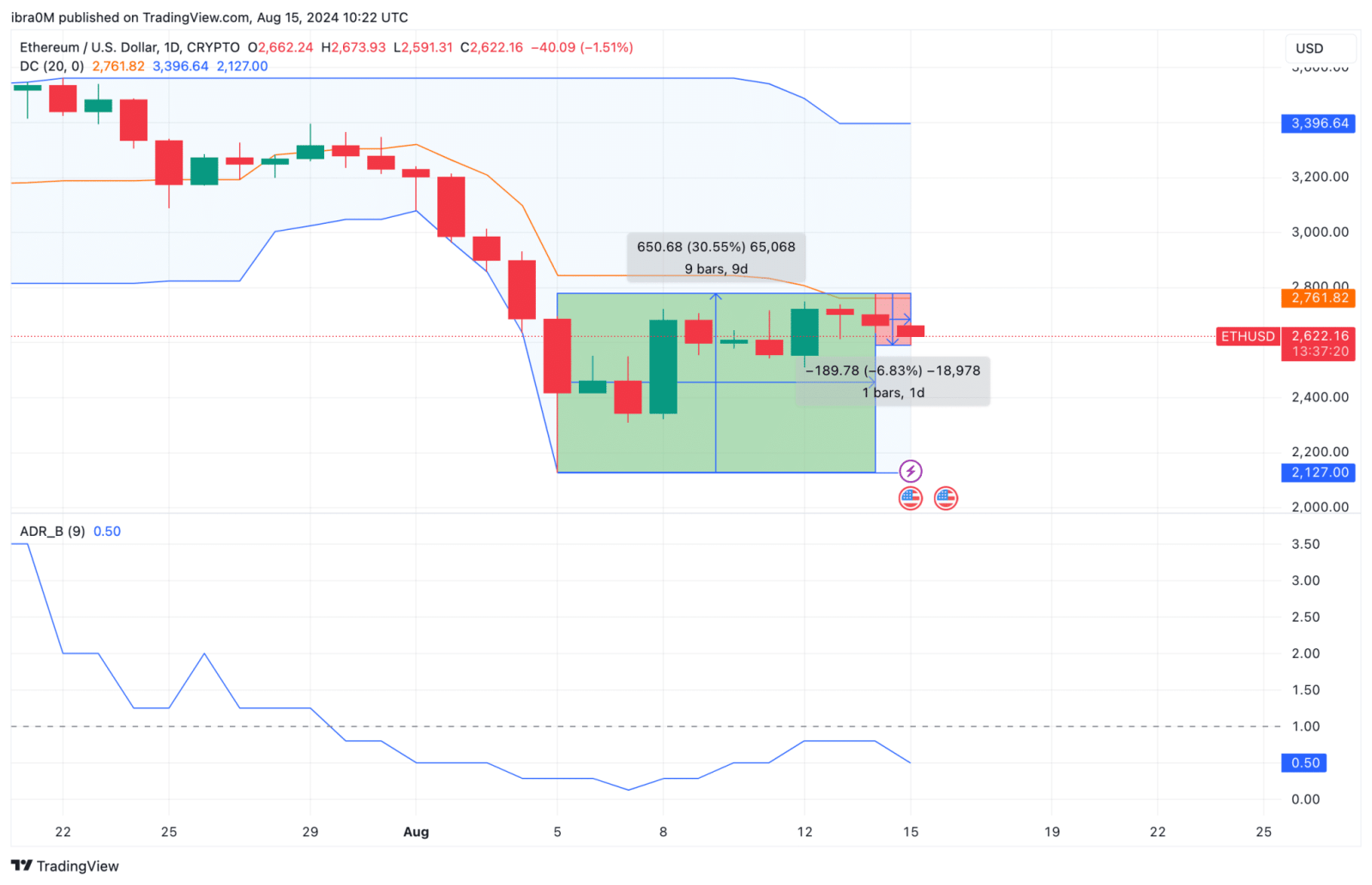

Ethereum’s price is currently struggling to maintain its recent gains, with technical indicators pointing to a potential reversal. The Donchian Channel indicator, as seen in the chart, shows that Ethereum’s price is hovering near the lower boundary, indicating strong resistance around $2,770. This level now serves as a key resistance point, with the price struggling to break above it.

Ethereum Price Forecast ETHUSD | TradingView

On the downside, support is visible around $2,500, as the chart suggests. If the bearish momentum continues, Ethereum could break below this support level, leading to a deeper correction. The Average Directional Index (ADR) further supports this bearish outlook, as it indicates a weakening trend. The combination of these factors suggests that Ethereum is at risk of a $2,500 reversal, with bears tightening their grip on the market.

In conclusion, Ethereum’s recent rally appears to be losing steam, with bearish sentiment in the derivatives markets and technical indicators pointing to a potential correction. If the bears maintain control, ETH could face a sharp decline toward $2,500 in the near term.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur