Ethereum Technical Analysis: Indicators Signal Caution for Ether as Bears Maintain Control

Ethereum’s price on August 19, 2024, stands at $2,582, with a 24-hour intraday range of $2,572 to $2,681. The cryptocurrency recorded a trading volume of $9.5 billion, contributing to a market capitalization of $310 billion. Despite these figures, ethereum’s technical indicators reveal a bearish outlook, signaling caution for traders.

Ethereum

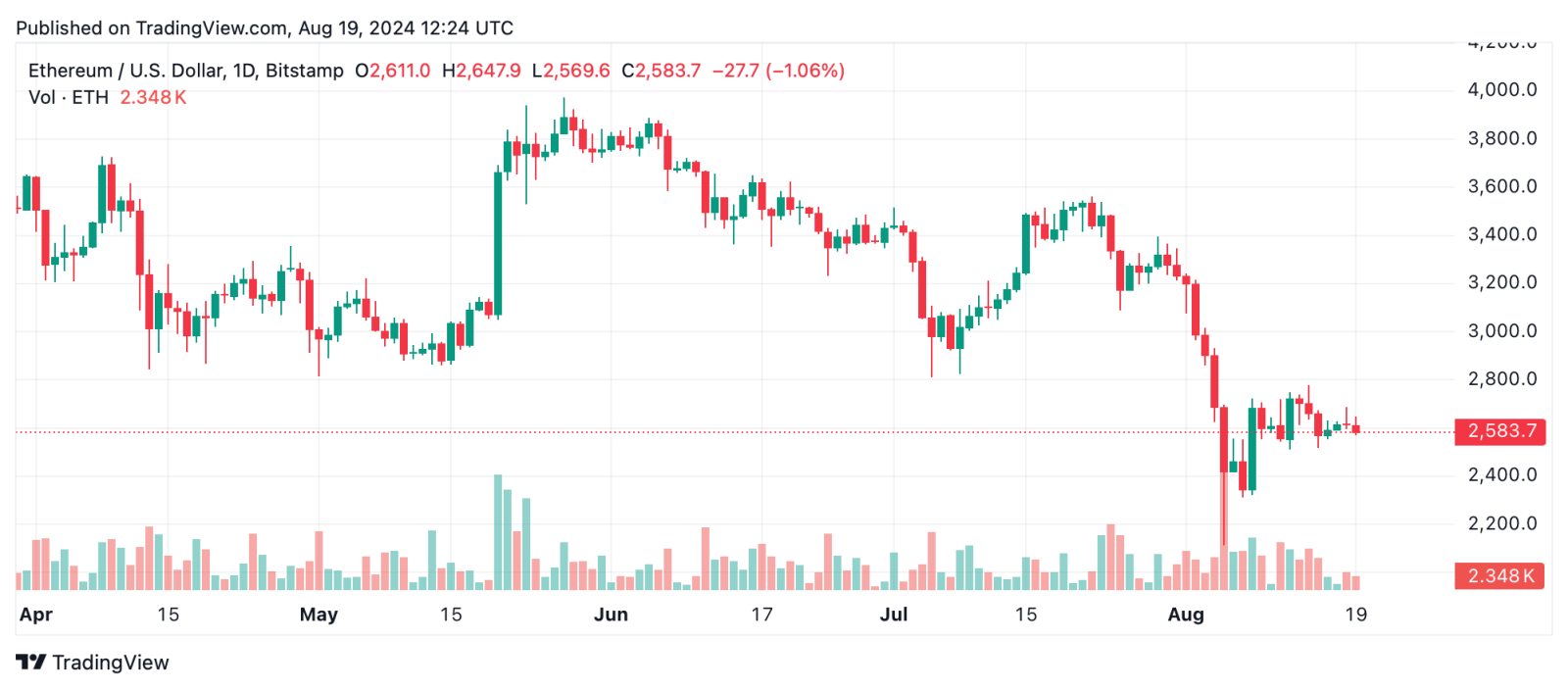

Ethereum’s daily chart paints a clear picture of the prevailing bearish trend. After a sharp decline from around $3,565 to a low near $2,017, the market shows signs of indecision, characterized by small movements. Volume analysis further corroborates this sentiment, with a peak of volume near the recent low, signaling a potential capitulation point. Support is found around $2,017, with resistance expected in the $2,800 to $3,000 range, where previous support has turned into resistance.

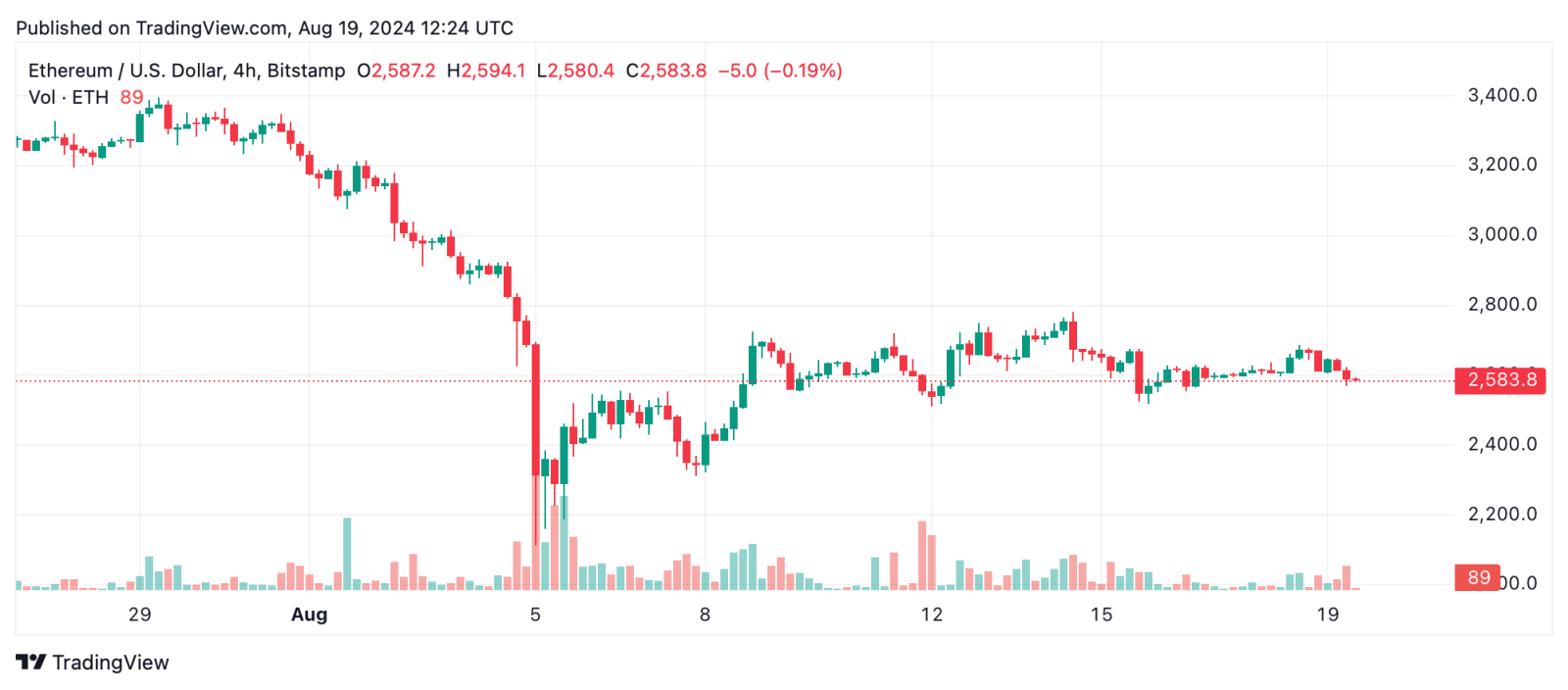

ETH/USD 4-hour chart on Aug. 19, 2024.

On the 4-hour chart, ethereum continues its downward trajectory with lower highs and lower lows, highlighted by a recent sharp drop to $2,515, followed by a modest recovery. The volume spikes on the downturns indicate strong selling pressure, particularly during the drop. Support is now positioned around $2,515, with resistance near $2,700, where the price retraced before declining again.

ETH/USD daily chart on Aug. 19, 2024.

The 1-hour chart reflects a micro downtrend within the broader bearish context. Following a dip to $2,565, ethereum attempted a recovery but has struggled to build momentum. Volume remains low except for spikes on large downturns, suggesting that selling pressure might persist. Key support lies around $2,565, with resistance at $2,688.

Oscillators across multiple time frames predominantly signal neutrality, with the relative strength index (RSI) at 38.9, the Stochastic at 64.8, and the commodity channel index (CCI) at -38.1. However, momentum indicators such as the moving average convergence divergence (MACD) level at -145.8 suggest a buy signal, indicating the potential for a short-term bounce. Nonetheless, the overall sentiment remains cautious due to the strong bearish signals from moving averages across the 10, 20, 50, 100, and 200-day periods, all indicating negative sentiment.

Bull Verdict:

Despite the prevailing bearish sentiment, a potential short-term reversal could be on the horizon, as suggested by buy signals from momentum indicators like the MACD. If ethereum can hold above the $2,600 support level and gain momentum, there might be room for a bullish bounce toward the $2,700 to $2,800 resistance levels. However, this outlook requires careful monitoring of volume and price action to confirm any bullish momentum.

Bear Verdict:

The overall technical landscape for ethereum remains bearish, with strong resistance and persistent selling pressure across all time frames. The consistent sell signals from moving averages and the struggle to gain momentum suggest that ethereum may continue to face downward pressure. Unless there is a significant shift in market dynamics, the path of least resistance appears to be lower, with key support levels at risk of being tested.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Basic Attention

Basic Attention  Qtum

Qtum  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur