Experts Eye Q4 as Turning Point for Bitcoin’s New ATH

Bitcoin (BTC) is poised for a potentially game-changing fourth quarter. This happens as historical patterns and expert predictions indicate a significant bull run on the horizon.

Despite recent fluctuations and an unclear trend, analysts are optimistic about strong performance in the last months of 2024, paving the way for considerable gains in the years ahead.

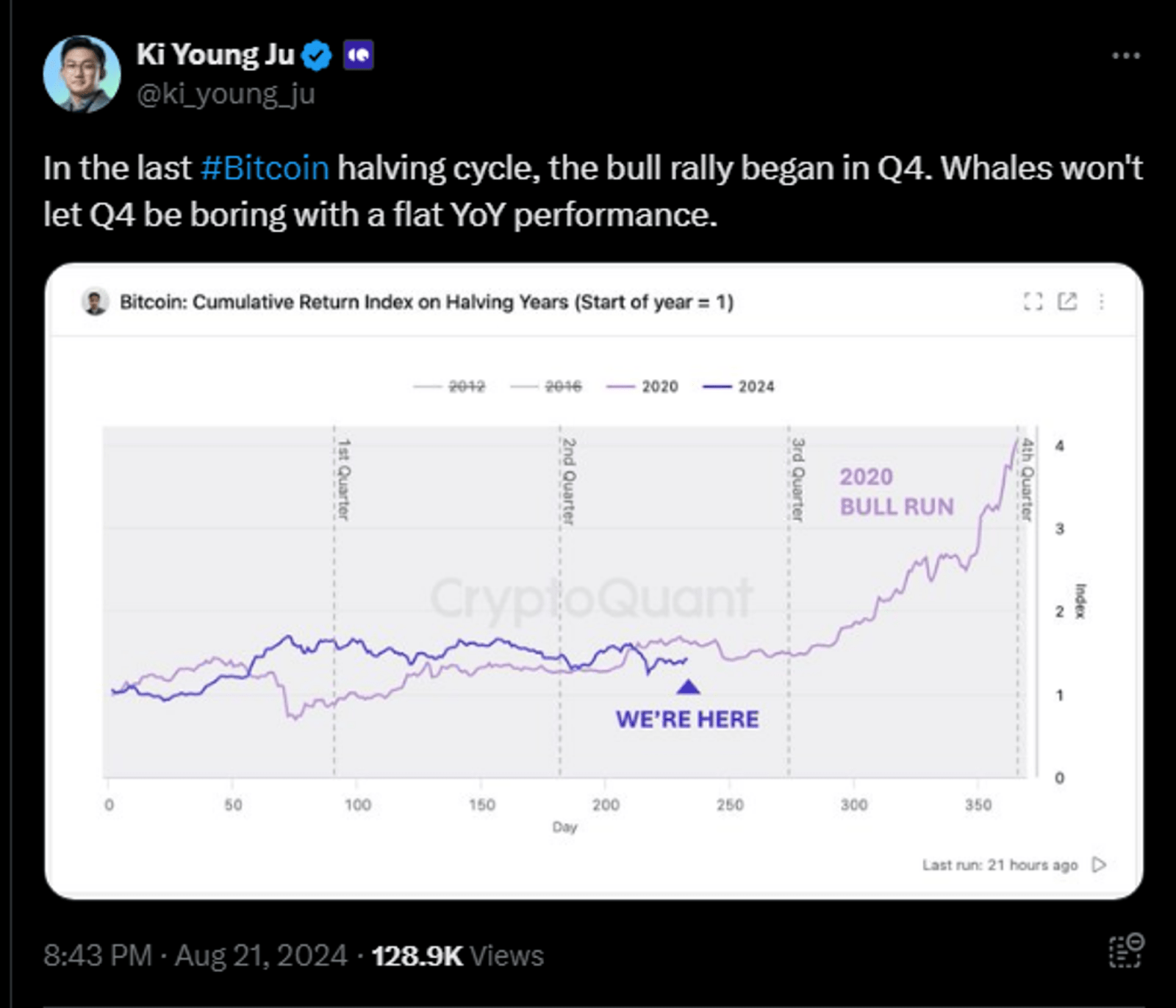

Historically, Bitcoin’s price during halving cycles has consistently demonstrated a robust rally in Q4.

Ki Young Ju, CEO of CryptoQuant, highlights this trend on X, noting that previous cycles saw Bitcoin prices surge as the year ended. Ju expects a repeat of this pattern, forecasting a robust finish to 2024.

Source: Ki Young Ju X

Currently trading around $61,000, Bitcoin is poised for potential growth. Ju’s analysis, in line with historical data, indicates that Q4 could be a pivotal time for a bullish breakout.

Analysts’ Forecasts Strong Q4 for Bitcoin

As reported by The Coin Republic, Ali Martinez on X pointed out on August 19 that “it’s been 119 days since the 2024 Bitcoin halving.” Historical trends show that Bitcoin often reaches a market peak approximately 530 days after a halving.

It’s been 119 days since the 2024 #Bitcoin halving. In the last two cycles, $BTC hit a market top around 530 days post-halving.

If history repeats, we’re still in the early stages of this cycle! pic.twitter.com/Yxxo7DLfsg

— Ali (@ali_charts) August 19, 2024

If this trend continues, Martinez suggests that Bitcoin might be entering the early phases of a parabolic run, with significant movements anticipated later this year.

CryptoCon, another prominent analyst, shares this optimistic outlook. As reported by The Coin Republic, CryptoCon has updated its November 28th Cycles Theory. It suggests that the current market activity is part of a larger trend that could lead to ATH.

I’ve made many improvements to the November 28th Cycles Theory since I created it in January 2023, but the original model’s idea remains intact.

Some people are calling for a #Bitcoin top or a recession, but I think the best is still yet to come.

The March 2024 local high has… pic.twitter.com/FR1MzhJrtp

— CryptoCon (@CryptoCon_) August 19, 2024

Despite recent market fluctuations, CryptoCon predicts that the peak could occur in late 2025, with a possible price target nearing $200,000. This forecast reflects a positive perspective on Bitcoin’s long-term path, setting the stage for a major rally in the months leading up to late 2025.

BTC Price Lacks Clear Direction

Despite the optimistic forecasts, Bitcoin’s present market behavior stands in stark contrast to earlier expectations.

Veteran trader Peter Brandt has recently pointed out that Bitcoin is currently trapped in a descending channel, showing no definitive trend. He observes that the BTC price action is creating a broadening triangle pattern, with no clear direction yet established.

Charts of continuing interest are Bitcoin and Ether.

Weekly and daily graphs continue to form a megaphone or broadening triangle pattern in BTC

No declaration of next trend yet $BTC$ETH will remain defensive unless/until close above 3050 occurs pic.twitter.com/aEESwhX5oC— Peter Brandt (@PeterLBrandt) August 20, 2024

The current market landscape indicates a lack of strong demand from large-volume investors, alongside a gradual recovery from April’s block subsidy halving. Predictions for new all-time highs this year have also diminished, with many forecasts turning out to be inaccurate.

Whales are anticipated to play a big role in influencing Bitcoin’s price movements in Q4. Ki Young Ju highlights that whales are likely to spark market activity, preventing stagnation and fostering a bullish sentiment.

Even with the current volatility and uncertain short-term trends, the overall perspective suggests that Bitcoin might be on the verge of a significant rally.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur