Is the microcap memecoin moment over?

Today, enjoy the Empire newsletter on Blockworks.co. Tomorrow, get the news delivered directly to your inbox. Subscribe to the Empire newsletter.

Are you having fun yet?

It’s been a while since we last covered Pump.fun or any celebrity memecoins.

The Solana-based dapp helped, as K33 analyst David Zimmerman, folks “digging for gold in the memecoin sector” by selling the “shovels.”

Pump’s revenue, which peaked in July, has fallen a little short so far this month. Though, to be fair, we still have a week left in the month.

Source: K33

“Pump’s simple idea has seen a massive inflow of users and the dapp has seen a meteoric rise, hitting revenue numbers that DeFi teams only dream about as it nears $100m in cumulative revenue since launch,” K33 analyst David Zimmerman wrote.

“At the time of writing, Pump has seen $520k in 24h revenue, which is followed by Solana at 356k, Ethereum at 336k, and Aave at 297k. The platform was set up in January, but only gained traction in March. Since then, revenue (in both absolute numbers and trajectory) has been one of the most impressive in DeFi history.”

Just how sustainable is Pump.fun?

Well, that’s where it gets a little tricky. At first, the “rising tide lifted all boats,” but since then — with the rate of launches (as seen below), the landscape has become a bit cannibalistic and competitive. This, Zimmerman argues, could make it “entirely unprofitable for traders” — if it hasn’t already.

Source: K33

Since January, 1,829,747 memecoins have been launched.

When the research note was published yesterday, at time of writing, there had been 10,740 token launches. Of those launches, only 136 tokens managed to top the $69,000 market cap needed to graduate to DEX trading.

There are now too many users with top wallets (meaning $100,000 to over $1 million in a ranking of profitable wallet tiers, which is a miniscule percentage of wallets) pumping and dumping tokens they’ve deployed themselves.

“For traders who wish to profitably trade newly launched memecoins, Pump initially offered a great venue. Due to the sheer volume of coins being produced, it is arguably impossible for users to do so now unless they are engaging in nefarious and manipulative on-chain activities,” Zimmerman said.

It’s also worth pointing out that others — like Justin Sun’s Tron — are trying to cut off a piece of the profitable pie by launching their own memecoin deployers. Just last week, Tron launched Sun.pump, which has already seen over 26,000 tokens created, per Dune.

But let’s not pretend the memecoin madness is only a Solana issue.

L1 and L2 token launches on Ethereum topped 403,000 last month, that’s just slightly more than the 398,000 seen on Pump.

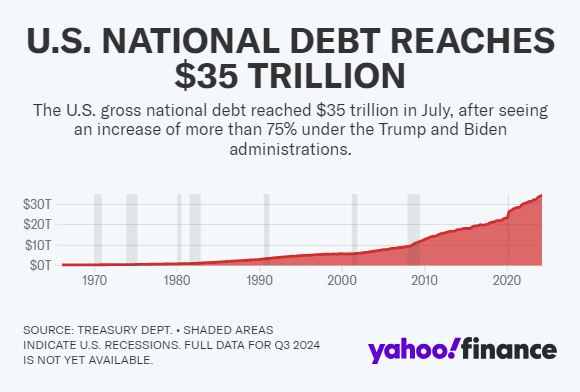

Zimmerman put it best: “The issues concerning Pump reflect the problems with crypto as a whole – a saturation of altcoins delivering little to no innovation with relatively little inflowing capital. With respect to trading, there is simply not enough new capital coming in to create that rising tide that lifts all boats, given the proliferation of altcoins.”

“This increasingly competitive landscape forces us to be more aggressive in our profit-taking and more agile in our rotations.”

Actually, there’s a meme that might really help you understand this situation:

Source: Looper

Ah, yes.

Not to say tossing blame isn’t a fun activity, but let’s be clear that we’ve said it once and we’ll say it again: This cycle is different. The liquidity available is different. And that means crypto will have to evolve and change the way it approaches certain aspects of the ecosystem.

Zimmerman wrote that there are still opportunities aplenty, though the micro-cap memecoin market may be exhausted.

— Katherine Ross

Data Center

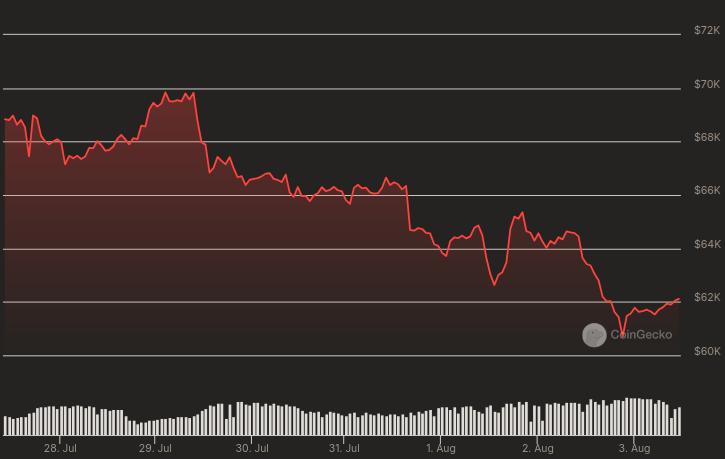

- BTC is eyeing another attempt at staying above $61,500, rising 3% in the past day.

- ETH is otherwise up 2.5% to $2,640. It hasn’t stayed above $2,700 since Aug. 14.

- Unofficial Trump memecoin MAGA has rallied 44% today but is still 78% below its June record high.

- It’s been almost one month since the last Ethereum validator was slashed. There were five in June and two in July.

- Arbitrum is beating Hyperliquid for weekly derivatives volume: $5.99 billion to $5.66 billion.

Dogecoin started the fire

Memecoins are not a fad.

They’ve transcended every crypto market cycle going back to dogecoin’s launch in 2013. That’s half a dozen bull and bear markets, and they’re as popular as ever.

Yes, there are hundreds, and even tens of thousands, pump and dumps every week. Some are successful but the overwhelming majority are not.

The cheaper networks — including BNB Chain, Solana, Base and more recently Bitcoin through Ordinals — can then be thought of as graveyards for all sorts of tokens and memecoins that never made it, or if they did, it was only for a brief while.

There are plenty of memecoins who do make it, even if it depends on your definition of success. There are currently 18 memecoins with a market cap of $250 million or more, the lower end of which are about the same as more serious projects including Arkham, Dymension, Manta and 1inch.

Another 180 or so have a market cap of $5 million or more and would likely be worth much less if any decent number of tokens were all sold at once.

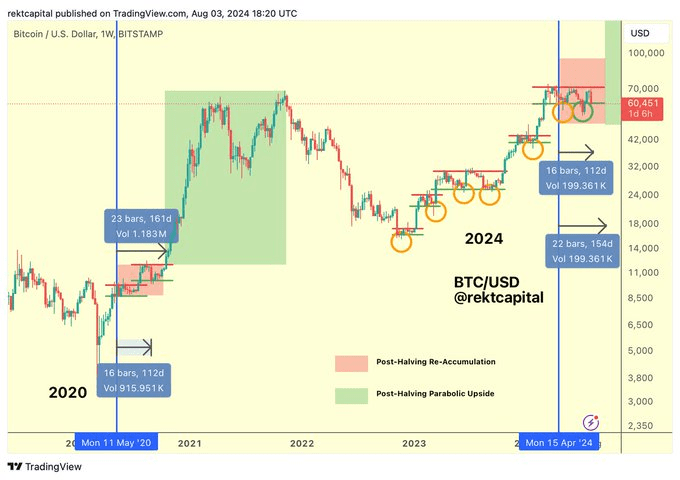

Still, tracking the top 50 or so memecoins by market cap over the past seven years shows that they indeed are slowly eating crypto. But they’ve recently hit a ceiling.

The chart below plots the dominance of memecoins against total capitalization of the crypto market. It doesn’t include all tokens. It does however cover about 95% of the total memecoin market value.

DOGE and SHIB are 75% of the total memecoin market right now, so it’s worth separating the rest to spot any trends.

Some caveats: market dominance usually refers to how much of the market is made up of a particular asset — bitcoin’s dominance right now is 57%, as it contributes that amount to the total crypto market capitalization.

In this case, bitcoin and ether were removed from that calculation. Memecoins, including ones that double as native tokens for their own standalone networks, are rarely intended to compete with either cryptocurrency, so it’s instead more interesting to gauge the relative dominance of memecoins against the rest of the crypto market.

The blue line meanwhile follows the market dominance of memecoins that aren’t dogecoin and shiba inu.

Notice that memecoin dominance has trended upwards ever since 2021. Elon Musk’s participation in the crypto zeitgeist was at its peak at the time, and he really liked to shill dogecoin.

Overall memecoin dominance, not including bitcoin and ether, is currently 6.5%. Without DOGE and SHIB it’s closer to 2.65%.

Dominance topped out at almost 10% in May 2021 and stopped just short of that at the end of May this year.

Perhaps the most telling is that the blue line reached its all-time high around the same time, and had been trending upwards even as the purple line retraced between November 2022 (FTX’s collapse) and February this year.

It shows that newer memecoins, at least the ones that survive, are indeed finding solid footing within the context of the wider crypto market.

Crypto is many things and one of them is pure peer-to-peer financial anarchy. And that’s the hook that piques the interest of many newcomers to the space.

If the core of crypto and blockchain — pseudonymity, untraceability and censorship resistance — has at all been eroded by waves of regulation over the years, memecoin markets are carrying the torch.

— David Canellis

The Works

- Binance is looking to add 1,000 compliance roles this year as its spending in that area tops $200 million.

- Former FTX executive Ryan Salame wants to walk back his guilty plea after claiming that the feds broke part of the plea deal.

- Binance CEO Richard Teng urged the Nigerian government to “get him home,” referring to executive Tigran Gambaryan who remains detained in the country.

- Crypto is dominating corporation spending this election cycle, according to Public Citizen data.

- SunPump flipped Pump.fun in newly created tokens on Wednesday.

The Riff

Q: Is memecoin mania over?

One thing that came out in the data was that memecoin dominance tends to correlate with the wider crypto market.

There’s often a lag of a few months, but if crypto goes up, generally so does memecoin market share.

So the memecoin moment could be over (for now) if crypto takes an extended breather from here.

It seems obvious that memecoin launchpads would persist throughout market cycles, just like memecoins themselves.

And defining this cycle by the advent of ETFs, rebirth of prediction markets and popularity of memecoin launchpads wouldn’t be the worst thing for the space. At least those all make decent revenue.

P.S. Yesterday, I wrote that Franklin Templeton uses Ethereum for its money market fund. It actually uses Stellar and Polygon, as one reader pointed out via email overnight. Thanks!

— David Canellis

I think it’s a tired play.

It’s undoubtedly fun and it has offered a ton of opportunities, but it’s risky and now, as Zimmerman wrote in his note yesterday, it’s increasingly hard for traders to walk off with a profit.

Is that to say crypto can’t still have fun? Of course not. There’ll be other plays or trends that allow folks to make some money while also having a good time, that’s the nature of certain parts of crypto. If it’s not memecoin mania, I’m sure it’ll come back in another form soon enough.

But, for now, the (micro-cap) memecoin play ain’t it.

In some ways, this is a good thing. Crypto’s evolving, and we have to change with it. I can also understand that some folks may not want to embrace the change.

As for me, I’m always excited about what’s around the next corner. So let’s bring on the next chapter.

— Katherine Ross

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur