VeChain (VET) Eyes Major Breakout as Bullish Patterns Emerge and Resistance Levels Nearing a Test

- VET’s possible inverse Head & Shoulders pattern signals potential bullish reversal if the neckline is decisively broken.

- Analysts predict VET could reach $0.0388 to $0.070 in 2024 if it breaks key resistance levels and holds its 200-Day Moving Average.

- VeChain’s focus on enterprise solutions, like tokenizing UFC gloves, continues to strengthen its real-world utility and long-term prospects.

VeChain (VET) has been facing a test in the market, hovering around crucial resistance levels. Recent activity shows a struggle to break out of these ranges, but the growing sentiment around the token indicates a positive outlook.

With technical indicators suggesting bullish patterns, VET could be on the verge of a notable upward shift if it manages to surpass these hurdles. Notably, the token has shown resilience, and with key resistance levels nearing a breakthrough, the potential for price movement remains strong.

#Vechain #VeFam $VET

Here’s an analysis of #VeChain ( $VET ) based on the latest information available up to August 17, 2024:

Current Market Sentiment and Price Analysis:

– **Price Movement**: $VET has been hovering around significant resistance levels, with recent posts… pic.twitter.com/ANfza9LBLW

— George Stamatopoulos Ⓥ (@gstamato) August 17, 2024

Technical Indicators Point Towards Potential Growth

Vechain has been possibly forming an inverse Head & Shoulders pattern, which is known for signaling a potential bullish reversal. If this pattern holds and the neckline is broken, analysts anticipate a substantial price surge.

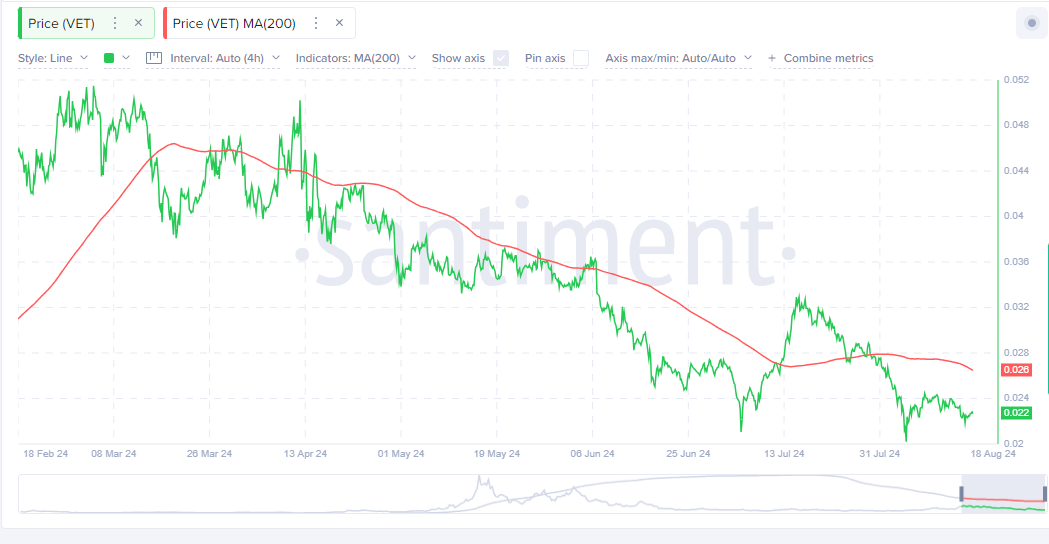

Source: Santiment

Additionally, VET regaining the 200-Day Moving Average adds to the optimism, pointing toward a stronger upward trend. Traders are also closely watching Fibonacci extensions and previous resistance levels, suggesting potential targets if VET continues its upward momentum.

Current price predictions vary, with estimates for 2024 ranging from $0.0388 to more optimistic projections of $0.070. The market’s reaction to breaking through resistance will be crucial in determining VET’s next moves. However, if these technical indicators play out as expected, VET could experience significant growth in the coming months.

Enterprise Use and Community Development

VeChain’s focus on enterprise adoption, particularly in supply chain management, continues to strengthen its position in the market. The recent development of tokenizing UFC fighter gloves exemplifies how VeChain is expanding its real-world applications. This emphasis on utility, rather than speculative growth, sets VeChain apart in a volatile crypto market.

Moreover, the VeChain community remains dedicated to long-term development, further solidifying its reputation. As partnerships and real-world use cases increase, VET’s potential for growth becomes more apparent. Additionally, broader market conditions, such as the anticipation of Bitcoin halving and ETF approvals, could indirectly support VET’s performance in the near future.

Market Sentiment Remains Cautiously Optimistic

Within the VeChain community, there is a notable sense of cautious optimism. Analysts and holders alike are keeping a close watch on VET’s price movements, particularly as it approaches key resistance levels.

Historical patterns are also being studied, with some expecting substantial growth if VET manages to mirror past price behaviors. Technical analysis continues to play a crucial role in the community’s outlook, with chart patterns and signals being closely monitored for any signs of a breakout.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur