We asked Swan CEO about layoffs, withdrawal times, and the canceled IPO

A few months ago, Swan Bitcoin was climbing the ranks among the world’s largest Bitcoin companies. It passed $220 million in annualized revenue, planned to IPO on the Nasdaq, was mining 1.7% of the entire Bitcoin network (11.3 exahashes per second), and scheduled its third annual conference along with an additional events business.

Not only that, on May 7, Swan confirmed rumors that had circulated since January that it had partnered with Tether for its Managed Mining business.

As of January 12, the company had taken in approximately $25 million of a $30 million convertible note leading into its Series C financing. As Wall Street knows, by the time a company gets past a C or D round, an IPO is likely around the corner.

However, a few days ago, Swan announced a massive round of layoffs, canceled its conference, and suspended its IPO plans. According to CEO Cory Klippsten, the IPO plan was shelved because Swan “didn’t carry forward with a big financing partner for our Managed Mining business.”

Protos asked the Swan CEO to explain the cancellation.

Swan CEO Cory Klippsten on IPO, downsizing

According to Klippsten, the IPO plan depended on revenue from Swan’s mining joint venture that Swan managed since inception. “The recent disagreement with a major capital partner meant that we no longer have a path to IPO in the near term and also no longer have the expectation of significant near-term cash flow from mining,” he told Protos.

Klippsten also denied that there were ulterior reasons for the cancellation, explaining that four of Swan’s major products have been performing well. “Financial services revenue was up 132% year-over-year in the first half of 2024, with significant growth across all four of our major products: Swan App, Swan Private, Swan IRA, and Swan Vault,” he said.

Although Swan increased marketing expenses and deliberately hired more employees in anticipation of filing for SEC approval of its IPO documents, “With the reason and the cash for aggressive spending gone, we had to cut both marketing and staff,” Klippsten concluded.

Read more: Some Swan Bitcoin customers lose banking access

Swan responds to withdrawal processing times

In the wake of the disappointing IPO and downsizing news, critics were quick to sound alarms about customers withdrawing their bitcoin. The history of crypto has endless examples of small financial problems cascading into major catastrophes from Vauld, Celius, Voyager, FTX, or countless others, so their concerns were understandable.

So far, Swan has processed withdrawal requests and aims to assure its customers that it is unlike those failures. Swan co-founder Yan Pritzker responded to the most vocal criticism directly, clarifying that although compliance has extended withdrawal times recently, Swan is honoring all valid withdrawal requests.

Bitcoin transaction fees

Other critics highlighted a potential mismatch between the self-custody practice that Swan encourages and Bitcoin’s expensive fees for on-chain withdrawals. Indeed, Swan is a vocal proponent of self-custody, encouraging customers to withdraw their purchases. However, it is expensive to deal with small amounts of bitcoin due to persistently high bids for block space.

Specifically, bids for a single bitcoin transaction are currently $0.56 and occasionally spike above $100. For distinct withdrawals of just a few dollars apiece, critics speculated that Bitcoin’s fees might be a persistent drain on Swan’s profitability.

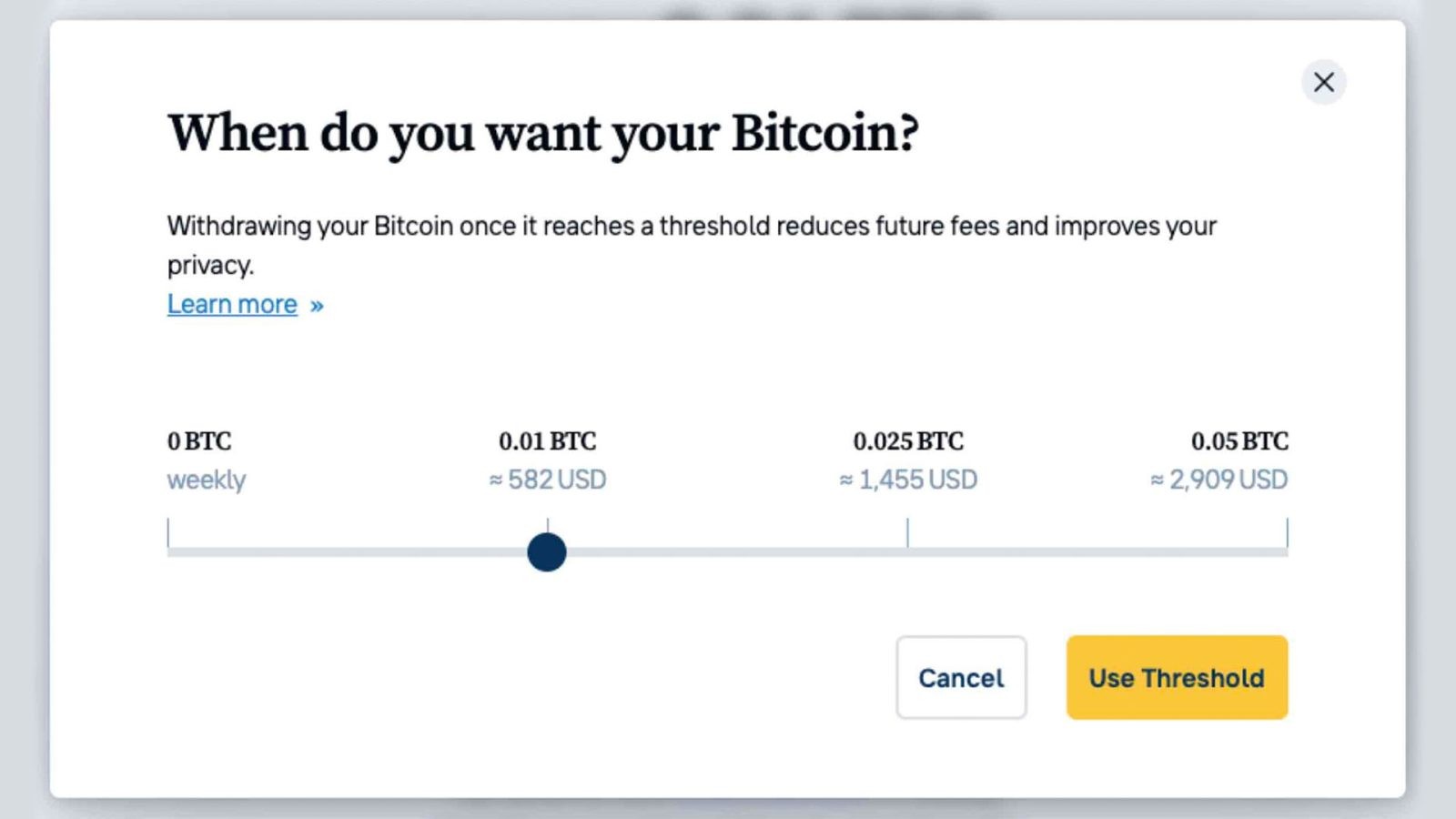

Klippsten responded to this speculation in a comment to Protos. “Swan offers free automated withdrawals at certain thresholds that create reasonably sized UTXOs. Some clients like to withdraw based on time, not amount. For these clients, we provide an option to withdraw weekly. We tell clients that withdrawing their Bitcoin once it reaches a certain threshold reduces future fees and improves privacy. It has no effect on Swan’s finances as we batch withdrawals anyway.”

A screenshot of the Swan App withdrawal threshold selector.

Read more: Swan Bitcoin questioned over unnamed investor and new trading fund

Comments on Pacific Bitcoin, Vault, and Force

Protos also asked Klippsten to explain the reasons for canceling what would have been its third annual Pacific Bitcoin conference. “We’re fully focused on Swan’s core business right now, and after going through a staff reduction last month, it just doesn’t feel like the right time for a festival,” he explained. “We’re doing a smaller one-day event for clients and partners during the conference’s planned dates, and we hope to bring Pacific Bitcoin back in 2025.”

Klippsten also confirmed to Protos that, despite the latest round of staff cuts, Swan Vault and Swan Force are still operational.

“We already built and launched Swan Vault [which] gives clients full control over their money without having to go it alone,” he said.

“Swan Vault has its roots in our acquisition of Specter Solutions and its team in 2022, which drove development of the open-source Specter Desktop project.”

Klippsten also reiterated that “Swan Force, our referral program, still exists.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur