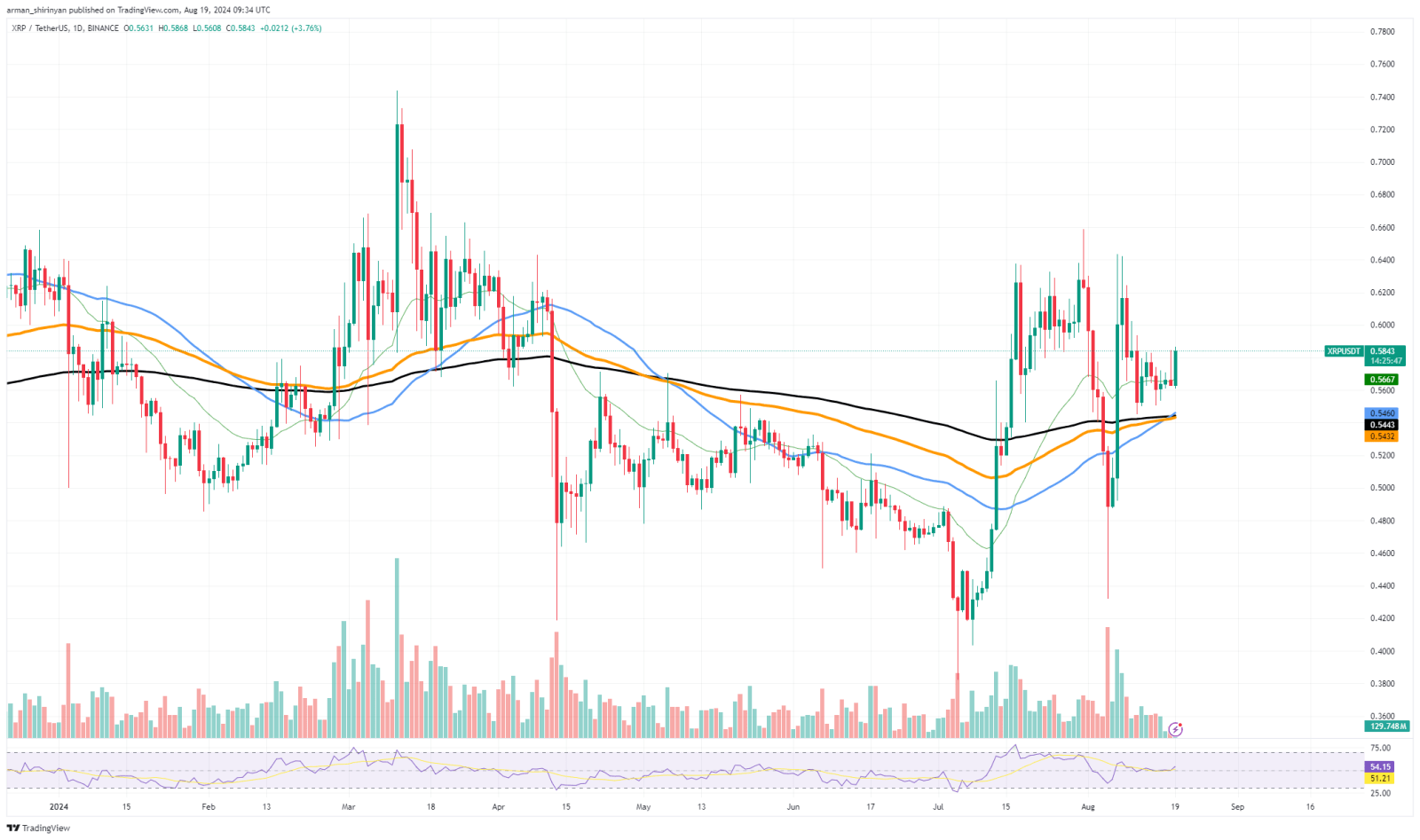

XRP Golden Cross Done

Recently XRP saw the formation of a golden cross, a technical pattern that is frequently taken as a bullish indication by the market. This happens when a long-term moving average crosses above a short-term moving average, suggesting that momentum may be about to change.

This cross indicates that the market is getting better for XRP and that the asset may be headed for a comeback. A pivotal point has been reached on the XRP chart with the golden cross, particularly given the recent lackluster performance of the market. Usually this crossover indicates the start of a longer-term uptrend that could draw in more buyers and improve the asset’s position.

Following the golden cross, there has already been some positive momentum in the price action, with XRP making an attempt to breach significant resistance levels. It is important to proceed cautiously with this optimism, though. Long-term analysis indicates that XRP is still in a wider downtrend, even with the short-term bullish signal. Any significant rebound from the asset’s recent strong resistance and selling pressure could be thwarted.

Even though the recent price increase is encouraging, it is still contained within the current downward trend, so it is unclear if XRP will be able to maintain this positive momentum. It is imperative for market participants to take into account the broader context of the cryptocurrency market.

Even though the golden cross is a good sign, there is still a lot of uncertainty on the market, and important assets like Ethereum and Bitcoin are giving mixed signals. The way the market as a whole performs in the upcoming weeks will probably affect XRP’s course.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  TRON

TRON  Cardano

Cardano  Stellar

Stellar  Chainlink

Chainlink  Hedera

Hedera  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  LEO Token

LEO Token  Monero

Monero  Cronos

Cronos  Dai

Dai  Ethereum Classic

Ethereum Classic  OKB

OKB  Algorand

Algorand  VeChain

VeChain  Cosmos Hub

Cosmos Hub  Gate

Gate  KuCoin

KuCoin  Stacks

Stacks  Tezos

Tezos  Theta Network

Theta Network  IOTA

IOTA  Tether Gold

Tether Gold  Zcash

Zcash  TrueUSD

TrueUSD  NEO

NEO  Polygon

Polygon  Decred

Decred  Dash

Dash  Ravencoin

Ravencoin  Qtum

Qtum  Basic Attention

Basic Attention  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Synthetix Network

Synthetix Network  Holo

Holo  Siacoin

Siacoin  DigiByte

DigiByte  Enjin Coin

Enjin Coin  Ontology

Ontology  Nano

Nano  Status

Status  Hive

Hive  Waves

Waves  Lisk

Lisk  Steem

Steem  Numeraire

Numeraire  Pax Dollar

Pax Dollar  BUSD

BUSD  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur